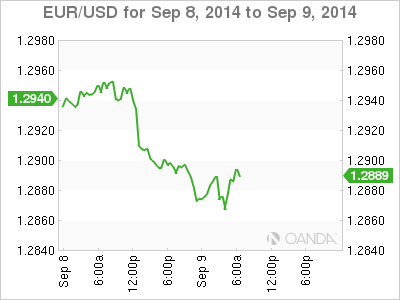

The euro is stable but under pressure on Tuesday, as EUR/USD has dropped below the 1.29 level for the first time since July 2013. It's another quiet day on the release front, with no major events in the Eurozone. In the US, today's highlight is JOLTS Jobs Openings. The employment indicator has improved over three consecutive releases, and the upward swing is expected to continue, with an estimate of 4.72M.

US numbers continue to point to a deepening recovery, but the labor market is showing some signs of trouble. On Friday, the eagerly-anticipated Nonfarm Employment Change crashed to 142 thousand, its lowest gain since January. This surprised the markets, which had expected a gain of 226 thousand. The disappointing release follows a weak ADP Nonfarm Payrolls report as well as a rise in unemployment claims. The markets are hoping for some relief from JOLTS Jobs Openings, which is expected to improve in the August release.

Elsewhere in the US, there was positive news from last month's services and manufacturing PMIs. ISM Non-Manufacturing PMI continued its impressive climb, hitting 59.6 points, well above the estimate of 57.3. ISM Manufacturing PMI climbed to 59.0 points, beating the forecast of 57.0 points. The impressive readings from the manufacturing and services sectors point to a balanced economic recovery. If US numbers continue to point upwards, we could see an interest rate hike in the early part of 2015.

German Trade Balance started off the week in fine fashion, as the trade surplus climbed to EUR 22.2 billion, up from 16.2 billion a month earlier. This easily beat the estimate of 17.3 billion. The strong figure follows impressive German manufacturing data last week. Industrial Production gained 1.9%, its strongest showing in 2014. This handily beat the estimate of 0.5%. Factory Orders sparkled with a 4.6% last month, its highest gain since November 2011. This easily beat the estimate of 1.6%, and follows two straight declines.

Dramatic and unexpected monetary action by the ECB on Thursday sent the euro reeling below the 1.30 level. The markets had not expected any change to interest rates, but the ECB took the axe for the second time in three months, cutting the benchmark rate to a record low of 0.05%, down from 0.15%. As well, the deposit facility rate was lowered to -0.20% from -0.10% and the marginal lending rate dropped to 0.30% from 0.40%. ECB head Mario Draghi had more in store, saying that the central bank plans to implement an asset purchase program (QE). No details of a QE scheme were provided, but the ECB said it would release details in October. The interest rate cuts and QE scheme are intended to bolster anemic growth in the Eurozone and combat the growing threat of deflation. Draghi is using everything he can lay his hands on in the ECB toolbox, and time will tell if the latest measures have a positive effect on the stumbling Eurozone economy.

EUR/USD 1.2890 H: 1.2890 L: 1.2859

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.