The euro is calm on Friday, as EUR/USD trades quietly in the high-1.33 range in the European session. There are no economic releases out of the Eurozone or US today. The markets will be closely monitoring the symposium in Jackson Hole, Wyoming, with Federal Reserve Chair Janet Jackson and ECB President Mario Draghi scheduled to speak on Friday.

Financial leaders and central bankers from around the world have gathered in picturesque Jackson Hole, Wyoming. This is Janet Yellen's first appearance as Fed chair at the conference, and she will deliver a keynote speech on Friday. Mario Draghi is scheduled to speak about labor market dynamics, but the markets will be hoping to hear some ideas about how the ECB plans to tackle the lack of inflation and growth in the Eurozone. There is speculation that Jackson Hole could be a currency event, which would be a marked departure from the conference's usual focus on the US labor market and monetary policy. If this is the case, we could see a sharp reaction from the currency markets. Traders should therefore be prepared for some movement from EUR/USD during the day.

US releases wrapped up the week on a high note. Unemployment Claims improved to 298 thousand, lower than the estimate of 302 thousand. The key indicator has now beaten the estimate in six of the past seven readings. Thursday's other key event, the Philly Fed Manufacturing Index, shot higher in July, rising to 28.0 points. The markets had expected the indicator to slip to 19.7 points. There was more good news on the housing front, as Existing Home Sales improved to 5.15 million, well above the estimate of 5.01 million. This marked the highest level we've since September 2013. What is particularly encouraging is that the data stems from a wide range of sectors, which points to balanced economic growth.

The Federal Reserve released its policy meeting minutes on Wednesday. The minutes were hawkish in tone, with the Fed saying that an interest rate hike could come sooner rather than later if employment numbers continue to improve. The Fed said that the economy continues to improve, but the QE program, which is scheduled to wind up in October, will not be accelerated. Once the asset purchase scheme is terminated, the guessing game regarding the timing of a rate hike will only intensify. Will Janet Yellen provide some clues when she speaks in Jackson Hole?

On Thursday, the Eurozone released Services and Manufacturing PMIs, and the results were mixed. French Manufacturing PMI came in at 46.5 points, the fourth straight reading below 50, which separates between contraction and expansion. French Flash Services PMI came in at 51.1, above the estimate. In Germany, the Service and Manufacturing PMIs both softened in July but beat the estimates. Eurozone Manufacturing and Services PMIs also weakened in July. There is cause for concern as most of the PMI readings were weaker compared to a month earlier, pointing to weaker growth in the Eurozone.

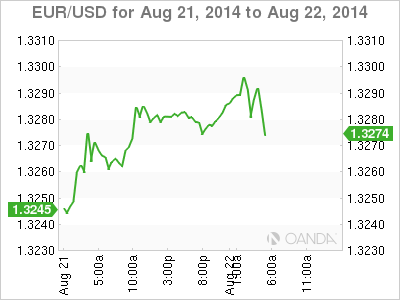

EUR/USD 1.3291 H: 1.3297 L: 1.3274

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

The EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 on Monday during the early Asian trading hours. The softer US Dollar provides some support to the major pair.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.