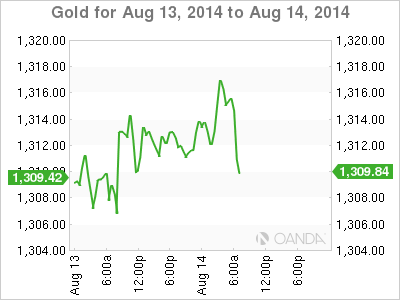

Gold is stable on Thursday, continuing a week in which the metal has shown little movement. The spot price stands at $1310.62 per ounce in the European session. On the release front, today's highlight is Unemployment Claims. The markets are expecting the indicator to rise back above the 300 thousand level, with an estimate of 307 thousand.

Gold prices remain above the key $1300 level, as the metal has benefited from the crises in Ukraine and the Middle East. Fighting continues between Ukrainian forces and pro-Russian separatists, and the UN says that over 2000 people have died in the past two weeks. In Iraq, Islamic State militants, who continue to make gains in Iraq, have attacked and displaced thousands of ethnic Kurds, which has resulted in a growing humanitarian crisis. US President Barak Obama has authorized air strikes against the militants in order to protect the Kurds and safeguard US interests. The situation in Iraq is volatile and could quickly destabilize even further. In Gaza, a ceasefire between Israel and Hamas has been renewed for five days, with negotiations over a long-term agreement expected to continue in Cairo.

In the US, retail sales data disappointed on Wednesday. Retail Sales dropped to a flat 0.0% last month, its weakest showing since January. The estimate stood at 0.2%. Core Retail Sales wasn't much better, posting a gain of 0.1%, down from 0.4% a month earlier. This was well short of the estimate of 0.4%. Retail sales are the primary gauge of consumer spending, and July's weak numbers points to a slow start to the third quarter. Although unemployment levels have dropped, this has not translated into stronger spending by the US consumer. We'll get a look at Unemployment Claims later in the day. The markets are expecting a weaker reading than the week before, with the estimate at 307 thousand.

XAU/USD 1317.42 H: 1311.31 L: 1310.62

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.