The Japanese yen is flat on Tuesday, as the pair trades slightly above the 102 line late in the European session. In economic news, today's US highlight is JOLTS Job Openings, with the markets expecting a strong reading. In Japan, Revised Industrial Production posted a sharp decline of 3.4%, well short of expectations. Later in the day, we'll get a look at GDP, one of the most important economic indicators, as well as the minutes of the last BOJ policy meeting.

Is the Japanese manufacturing sector in trouble? Japanese manufacturing indicators continue to post declines this week. Tertiary Industry Activity came in at -0.1%, short of the estimate of a 0.2% gain. Revised Industrial Production dropped 3.4% last month, its steepest fall since October 2012. Meanwhile, markets eyes on Japanese GDP, which will be released later on Tuesday. The markets are braced for a decline of 1.7%, in Q2, which would mark the first drop in economic activity since Q4 of 2012. Traders should be prepared for the yen to lose ground if GDP posts a weak reading.

In the US, employment indicators are under the market microscope, as the strength of the labor market is one of the most important factors influencing the Federal Reserve regarding the timing of an interest rate hike. A rate hike is expected by mid-2015, but stronger economic data, especially on the employment front, could hasten a rate move. We'll get a look at JOLTS Jobs Openings later on Tuesday. The indicator has been on an upswing and exceeded the estimate in the past two releases. Another rise is expected in the July release, with the estimate standing at 4.74 million.

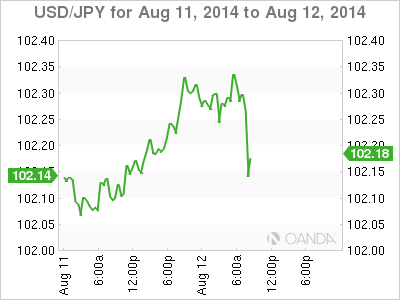

USD/JPY 102.17 H: 102.28 L: 102.14

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

US inflation data in the market purview

With next week's pivotal US inflation data looming, we're witnessing a stall in stock market momentum and an uptick in US Treasury yields. This shift comes amid murmurs of hawkish sentiment from Fed speak. Indeed the mind games intensify even further as investors cling to their rate cut hopes.