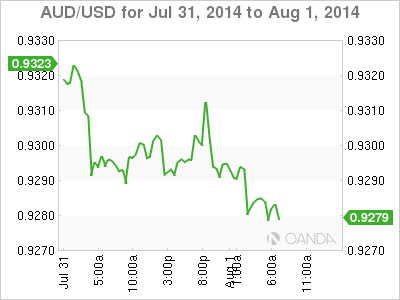

AUD/USD continues to lose ground on Friday, as the pair trades in the high 0.93-range in the European session. The struggling Australian dollar has surrendered over 100 points this week and is trading at its lowest level since early June. On the release front, Australian PPI posted a decline of 0.1%. In the US, the markets will have plenty of data to sort through, with three key events later in the day - Nonfarm Employment Change, Unemployment Rate and ISM Manufacturing PMI. We'll also get a look at consumer confidence levels, with the release of UoM Consumer Sentiment.

The Australian Producer Price Index is a key gauge of inflation in the manufacturing sector. The index disappointed in the second quarter, coming in at -0.1%. This was nowhere near the estimate of +0.7%, and marked a two-year low. PPI followed a weak reading from Building Approvals, which plunged 5.5% last month. If key data out of Australia continues to decline, the Aussie will be hard pressed to reverse its downward spiral.

On Thursday, Unemployment Claims came in at 302 thousand, higher than the previous release but very close to the estimate of 303 thousand. Earlier in the week, ADP Nonfarm Payrolls posted a sharp drop. If the official NFP release follows suit and misses the estimate of 234 thousand, the US dollar could give up some if its recent gains. Meanwhile, US GDP exceeded expectations in the second quarter, as the economy expanded at an annual rate of 4.0%. This easily beat the estimate of 3.1% and marked the strongest quarter of economic growth since Q4 of 2009. The boost in economic activity was helped by strong consumer confidence and business investment, as well as solid employment data. The US dollar took advantage of the strong numbers, posting gains against its major rivals, including the Australian dollar.

The Federal Reserve released a policy statement on Wednesday, with the Fed sounding somewhat dovish in tone. Policymakers acknowledged lower unemployment levels, but noted that "there remains significant underutilization of labor resources" in the economy. The Fed statement reinforces the view that the US central bank is in no rush to raise interest rates after the termination of QE, which is expected in October. As well, the Fed said that inflation levels have moved somewhat closer to the Fed's target of 2.0%.

AUD/USD 0.9279 H: 0.9317 L: 0.9276

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

GBP/USD hovers around 1.2500 on the stronger US Dollar, focus on BoE rate decision

The GBP/USD pair trades on a softer note around 1.2500 on Wednesday during the Asian session. The USD Index recovers modestly to 105.40, which drags the major pair lower. Investors focus on the upcoming Bank of England's monetary policy meeting.

Gold price recovers its recent losses, despite a firmer US Dollar

Gold price attracts some buyers during the Asian trading hours on Wednesday. Safe-haven demand, fueled by geopolitical tensions and uncertainty, as well as ongoing central bank purchases, might contribute to a rally in gold.

Ethereum resume sideways move as Grayscale files to withdraw Ethereum futures ETF application with the SEC

Ethereum is hinting at a resumption of a sideways movement on Tuesday after seeing inflows for the first time in seven weeks. Grayscale withdrew its application for an Ethereum futures ETF, and the SEC’s Chair Gary Gensler has also called most crypto assets securities.

No obvious macro catalysts to steer the bus

The US data calendar remains relatively light, with initial jobless claims and the University of Michigan survey being the key focus. However, these releases may not provide a significant catalyst for the next directional move in the US Dollar.