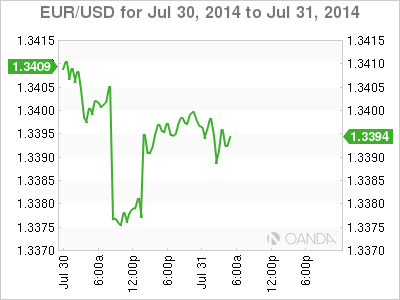

The euro is unchanged on Thursday, as EUR/USD continues to trade just shy of the 1.34 level in the European session. It's been a July to forget for the struggling euro, which has coughed up about 300 points to the surging US dollar. On the release front, Eurozone indicators were mixed. German Retail Sales and Unemployment Change beat their estimates, and French Consumer Spending posted another strong gain. Eurozone CPI and Unemployment Rate met expectations. In the US, today's highlight is Unemployment Claims. The markets are braced for a rise in claims, which would likely have a negative impact on the dollar.

Eurozone CPI, one of most important indicators, edged lower to 0.4%. Although this was close to the estimate of 0.5%, this figure was the lowest in almost five years, and raises concerns of deflation. There was better news from the Eurozone Unemployment Rate, which dipped to 11.4%, its lowest level since September 2012. German data was positive, led by Retail Sales which jumped 1.3%, beating the estimate of 1.1%. German Unemployment Change posted a decline of 12,000, easily surpassing the estimate of a drop of 5,000.

In the US, GDP soared in the second quarter, expanding at an annual rate of 4.0%. This easily beat the estimate of 3.1%. The boost in economic activity was boosted by strong consumer confidence and business activity in Q2. Meanwhile, ADP Nonfarm Payrolls was unable to keep pace. The key employment indicator dropped to 218 thousand, compared to 284 thousand a month earlier. This was well off the estimate of 234 thousand. If the official Nonfarm Payrolls follows suit with a weak reading on Friday, the US dollar could give up its recent gains.

CB Consumer Confidence was outstanding on Tuesday, pointing to a sharp increase in June. The key indicator jumped to 90.9 points, crushing the estimate of 85.5 points. This was the indicator's highest level since September 2007. Consumer confidence is closely tracked by analysts since a confident consumer is likely to increase consumption, which is critical for economic growth.

EUR/USD 1.3398 H: 1.3400 L: 1.3385

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.