The euro continues to lose ground on Wednesday, as EUR/USD trades below the 1.34 level in the European session. On the release front, it's a busy day, with three key events out of the US - Advance GDP, ADP Nonfarm Payrolls and the Federal Reserve Policy Statement. In the Eurozone, Spanish GDP met expectations, posting a healthy 0.6% gain. However, Spanish CPI softened in June, with a 0.3% decline. Late in the day, Germany releases Preliminary CPI, a key indicator and market-mover.

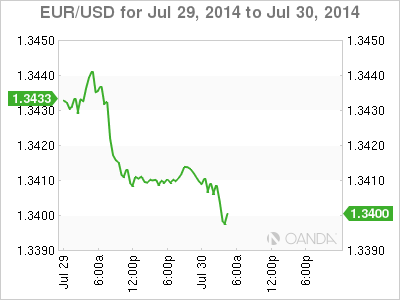

The euro continues to head south, and has dipped below the 1.34 line for the first time since November. It's been a July to forget for the euro, which has coughed up about 300 points to the surging US dollar. If Wednesday's US employment and GDP figures are positive, the euro could lose more altitude.

CB Consumer Confidence was outstanding on Tuesday, pointing to a sharp increase in June. The key indicator jumped to 90.9 points, crushing the estimate of 85.5 points. This was the indicator's highest level since September 2007. Consumer confidence is closely tracked by analysts since a confident consumer is likely to increase consumption, which is critical for economic growth.

In the Eurozone, soft German data continues to concern the markets. German Import Prices posted a gain of 0.2%, which was the best showing in 2014. This was shy of the estimate of 0.3%. On Friday, German Ifo Business Climate, a key indicator, dipped to 108.0 points, its third straight decline. On the inflation front, Germany has not been immune to Eurozone inflation woes, and we'll get a look at German Preliminary CPI later on Wednesday. The markets are expecting a weak gain of 0.2%.

EUR/USD 1.3399 H: 1.3416 L: 1.3395

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.