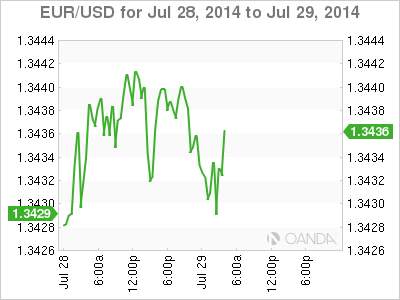

EUR/USD continues to show very little activity on Tuesday, as the pair trades in the mid-1.34 range in the European session. On the release front, it's another quiet day, with just one Eurozone release, as German Import Prices posted a weak gain of 0.2%. In the US, today's highlight is CB Consumer Confidence. The markets are expecting another strong showing from the June release.

The euro continues to trade at its lowest levels since November. Many investors remain on the sidelines, waiting for three key events on Wednesday which could move the markets. The Federal Reserve will release a policy statement and the markets will get a look at US Advance GDP and the ADP Nonfarm Payrolls. These events could shake up EUR/USD.

Soft German data continues to concern the markets. German Import Prices posted a gain of 0.2%, which was the best showing in 2014. This was shy of the estimate of 0.3%. On Friday, German Ifo Business Climate, a key indicator, dipped to 108.0 points, its third straight decline. On the inflation front, Germany has not been immune to Eurozone inflation woes, and we'll get a look at German Preliminary CPI on Wednesday, with the markets anticipating a small gain.

EUR/USD 1.3434 H: 1.3440 L: 1.3427

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.