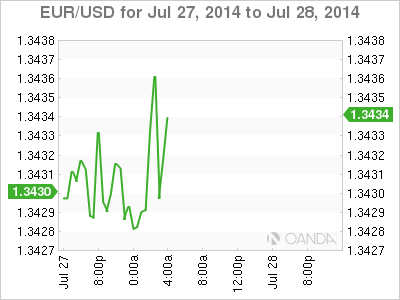

EUR/USD is unchanged on Monday, as the pair trades quietly in the mid-1.34 range in the European session. On the release front, it's a very quiet start to the week, with just two releases out of the US, highlighted by Pending Home Sales. There are no Eurozone releases on Monday.

On Friday, German Ifo Business Climate, a key indicator, dipped to 108.0 points, its third straight decline. There was better news from German Consumer Climate, which continued its upward trend, hitting 9.0 points, just above the estimate of 8.9 points. Germany has not been immune to Eurozone inflation woes, and we'll get a look at German Preliminary CPI on Wednesday, with the markets anticipating a small gain.

In one of the first signs that the ECB's recent rate cuts may be bearing fruit, Eurozone PMIs posted encouraging numbers on Thursday. German Services and Manufacturing PMIs improved in June and beat their estimates. Services PMI was particularly impressive, hitting a three-year high, at 56.6 points. In the Eurozone, Services PMI easily beat the estimate, while Manufacturing PMI met expectations. French data, however, failed to keep pace with its European counterparts. Manufacturing PMI came in below the 50-point level, the mark that indicates expansion, for a second straight month, indicating contraction in the manufacturing sector. Services PMI pushed above 50 for the first time since March.

In the US, a positive week ended on a high note, as durable goods data exceeded expectations. Core Durable Goods Orders jumped 0.8%, beating the estimate of 0.6%, and rebounding nicely from a decline of 0.1% in May. Durable Goods Orders followed suit, posting a gain of 0.7%, compared to a weak reading of -1.0% last month. This easily surpassed the estimate of 0.4%. Earlier last week, Unemployment Claims tumbled, as the key indicator fell to 284 thousand, its lowest level since February 2008. This surprised the markets, which had expected a reading of 310 thousand. The strong release continues a string of solid employment data, which has helped the dollar. As well, positive news on the employment front is bound to increase speculation about a rate increase by the Federal Reserve.

EUR/USD 1.3436 H: 1.3438 L: 1.3427

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.