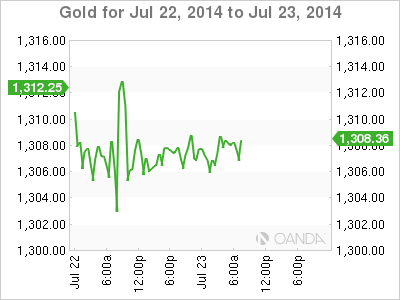

Gold is flat on Wednesday, as the spot price stands at $1307.44 per ounce late the European session. There is just one event on today's schedule, Crude Oil Inventories. Investors are waiting for new economic data, and on Thursday we'll get a look at Unemployment Claims and New Home Sales. On Tuesday, US data was a mix. CPI posted a weak gain as the key inflation index continues to struggle. Meanwhile, there was excellent news on the housing front, as Existing Home Sales exceeded expectations and hit its highest level in eight months.

US numbers were a mix on Tuesday. Inflation numbers continue to struggle, as Core CPI posted a paltry gain of 0.1%, shy of the estimate of 0.2%. The key index has looked anemic in 2014, with its highest gain this year at just 0.3%. CPI was bit stronger, as it gained 0.3% last month, matching the forecast. Meanwhile, Existing Home Sales jumped to 5.04 million, surpassing the estimate of 4.94 million. This was the best showing we've seen since October, and follows a disappointing release from Housing Starts, which was published last week.

Geopolitical tensions are bad news for the markets, which crave stability. With violence continuing in Ukraine and Gaza, nervous investors have rallied around the safe-haven US dollar as well as gold, at the expense of other currencies. In Ukraine, the downing of a Malaysian Airlines jet, apparently by pro-Russian separatists, has seriously frayed relations between the West and Russia, which have already been strained since the latter annexed Crimea. Fighting continues between the separatists and Ukrainian forces in Eastern Ukraine. The Europeans are threatening stronger sanctions against Russia, and escalating tensions in eastern Ukraine could shake up the markets. In the Middle East, the fighting in Gaza between Hamas and Israel has intensified, as Israel presses on with a land offensive and casualties rise on both sides. Meanwhile, the international community is intensifying efforts to broker a cease-fire, but in the meantime the fighting continues.

XAU/USD 1307.44 H: 1309.42 L: 1305.05

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.