Gold is trading just shy of the key $1300 level on Thursday. In the European session, the spot price stands at $1299.07 per ounce. On the release front, it's a busy day with three key events, Building Permits, Unemployment Claims and the Philly Fed Manufacturing Index.

Federal Reserve Chair Janet Yellen concluded two days of testimony on Capitol Hill on Wednesday, testifying before the House Financial Services Committee. Yellen declined to answer questions about when the Fed would begin to raise rates, but she did acknowledge that most economists expect the Fed to make a move in the third quarter of 2015. On Tuesday, the dollar moved higher when Yellen said that the economy still required monetary stimulus, but rates could increase sooner than expected if inflation and job numbers improved more quickly than anticipated. The Fed's asset purchase program (QE) has flooded the economy with over $2 trillion, keeping interest rates at ultra-low levels, but the Fed has been steadily reducing the program since last December. Currently, the Fed is pumping $45 billion/month into the economy, and the next taper is expected in August, with plans to terminate QE in October.

Recent US inflation numbers have been weak, so the markets were pleasantly surprised with the June release of the Producer Price index, the primary gauge of inflation in the manufacturing sector. The index improved to 0.4%, beating the estimate of.0.2%. Core PPI, which excludes volatile items, posted a weak gain of 0.2%, matching the estimate. With Janet Yellen telling Congress that a rate hike could be pushed forward if inflation and employment data exceeds expectations, stronger inflation numbers such as the June PPI will put more pressure on the Fed to raise rates.

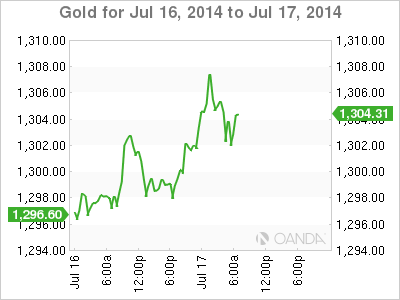

XAU/USD 1299.07 H: 1308.22 L: 1303.90

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.