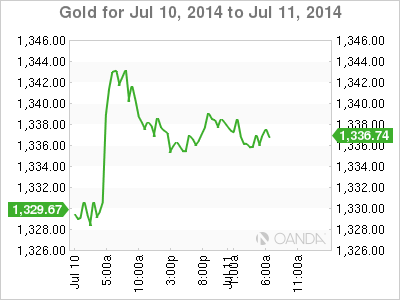

Gold is firm on Friday, as the spot price stands at $1337.62 per ounce in the European session. Friday has a very light schedule, with just one event, the Federal Budget Balance.

In the US, Unemployment Claims dropped, as employment data continues to impress. The key indicator dropped to 304 thousand, well below the estimate of 316 thousand. Employment numbers for June have looked sharp, led by a jump in Nonfarm Payrolls and a drop in the unemployment rate. The strong employment numbers have increased speculation about an interest rate hike by the Federal Reserve, and remarks by Fed policymakers will be under the market microscope.

The Federal Reserve minutes did not shed much light on when the Fed plans to raise interest rates, but policymakers did agree to wind up the QE scheme by October. The asset purchase program flooded the economy with over $2 trillion, and the Fed has been steadily reducing the program since last December. Winding down QE will require several more tapers by the Fed, but that shouldn't pose a problem, given the solid employment data the economy has been churning out.

XAU/USD 1337.62 H: 1338.93 L: 1334.62

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.