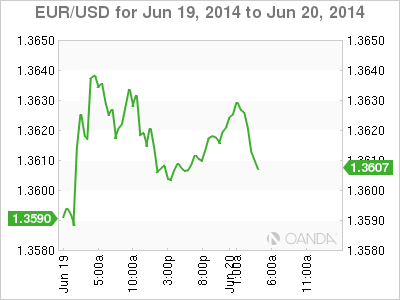

EUR/USD is firm on Friday, as the pair is back above the 1.36 line, after some gains earlier in the week. On the release front, German PPI posted its third consecutive decline, as Eurozone inflation indicators continue to falter. There was better news from Eurozone Current Account, which improved in May. Although US markets are open on Friday, there are no releases on the schedule, so traders should be prepared for a quiet day from the pair.

Eurozone inflation rates continued to look dismal in May, as German PPI posted another decline, coming in at -0.2%. The manufacturing inflation index has failed to post a gain in 2014, pointing to weakness in the German manufacturing sector. The ECB lowering rates earlier in the month, declaring that the moves were intended to bolster weak growth and inflation levels in the region. However, we'll have to wait for the June inflation data to see if the ECB's moves push inflation to higher levels. If not, the euro could lose ground against the dollar. Earlier in the week, German ZEW Economic Sentiment lost ground, although somewhat surprisingly, the same Eurozone indicator showed improvement. We'll get a look at Eurozone Consumer Confidence later on Friday. The markets are expecting another weak reading in May.

On Wednesday, the Federal Reserve continued to taper to its QE program, reducing the scheme by $10 billion, to $35 billion/month. If all goes as planned, the Fed could wind up QE in the fall. The Fed also hinted that interest rates will continue to stay low for the foreseeable future, which likely means that we won't see any rate hikes before the first quarter of 2015. With regard to economic activity, the Fed noted that the recovery is continuing, but it reduced its forecast of economic growth to 2.1-2.3%, down from an earlier forecast of around 2.9 percent. The bottom line? There were no dramatic items in the Fed statement, with one analyst describing current Fed policy as "steady as she goes". The US dollar has responded with losses against its major rivals, and the euro has added about 70 points this week and pushed across the 1.36 line.

EUR/USD 1.3609 H: 1.3634 L: 1.3605

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.