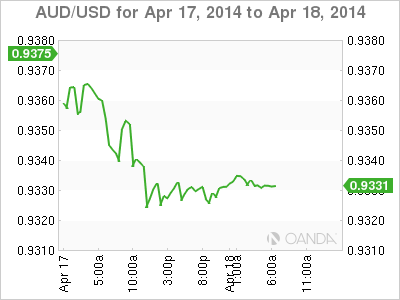

AUD/USD is unchanged in thin holiday trading, as the pair trades in the mid-0.93 range on Friday's European session. The Australian markets are closed, and there are no Australian or US releases.

In the US, Unemployment Claims rebounded sharply, as the key indicator dropped to 300 thousand last week. This beat the estimate of 314 thousand and marked the lowest reading since May 2007. With the Federal Reserve looking to trim its QE program and speculation rising about a possible interest rate increase, every employment release is under the market microscope. There was more good news from the manufacturing sector, as the Philly Fed Manufacturing Index soared to 16.6 points, its best showing since September. This was well above the estimate of 9.6 points.

Australian releases failed to impress on Thursday. NAB Quarterly Business Confidence dropped to 6 points in Q1, down from 8 points in Q4. New Motor Vehicle Sales, an important consumer spending indicator, declined by 0.3%, its second drop in three releases. Despite the weak numbers, the Aussie is holding its own as it remains at high levels against the US dollar.

Comments by Federal Reserve chair Janet Yellen on Wednesday continue to weigh on the US dollar. Yellen said there is little inflationary pressure on the economy, and it was unlikely that the Fed's inflation target of 2% would be met. She added that although the economy has showed signs of recovery, unemployment remains a sore spot. The Fed has abandoned its promise to maintain interest rates at least as long as the unemployment rate is above 6.5%, but the dovish stance we are seeing from Yellen means that a rate hike is unlikely in the near future.

The crisis in the Ukraine continues to simmer, as Russian President Vladimir Putin threatened to act his "right" to attack Ukraine. There have been several skirmishes between pro-Russian militiamen and Ukrainian forces, and casualties have been reported on both sides. Secretary of State John Kerry and his Russian counterpart met on Thursday, but a quick resolution is unlikely. Western Europe is dependent on Russian oil and gas, so we can expect the markets to react if the crisis intensifies.

AUD/USD 0.9332 H: 0.9338 L: 0.9324

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.