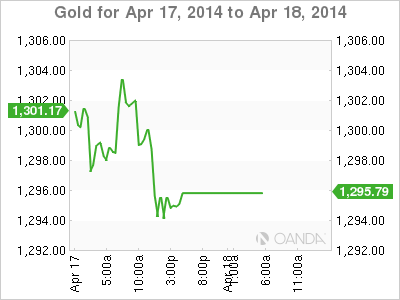

Gold prices dipped on Thursday, falling below the key $1300 level, as excellent readings from Unemployment Claims and the Philly Fed Manufacturing Index helped push down the precious metal. On Good Friday, gold is trading quietly, with a spot price of $1294.80. We can expect thin trading during the day, with no releases out of the US.

US releases ended the week on a high note, as employment and manufacturing numbers were strong. The all-important Unemployment Claims was up slightly to 304 thousand, but had no trouble beating the estimate of 316 thousand. With the Federal Reserve planning another trim to its QE program at the end of the month and speculation rising about a possible interest rate increase next year, every employment release is under the market microscope. Meanwhile, the Philly Fed Manufacturing Index soared to 16.6 points, its best showing since September. This was well above the estimate of 9.6 points.

Comments by Federal Reserve chair Janet Yellen on Wednesday continue to weigh on the US dollar. Yellen said there is little inflationary pressure on the economy, and it was unlikely that the Fed's inflation target of 2% would be met. She added that although the economy has showed signs of recovery, unemployment remains a sore spot. The Fed has abandoned its promise to maintain interest rates at least as long as the unemployment rate is above 6.5%, but the dovish stance we are seeing from Yellen means that a rate hike is unlikely in the near future.

The crisis in the Ukraine continues to simmer, as Russian President Vladimir Putin threatened to act his "right" to attack Ukraine. There have been several skirmishes between pro-Russian militiamen and Ukrainian forces, and casualties have been reported on both sides. Secretary of State John Kerry and his Russian counterpart met on Thursday, but a quick resolution is unlikely. Western Europe is dependent on Russian oil and gas, so we can expect the markets to react if the crisis intensifies.

XAU/USD 1294.80 H: 1294.80 L: 1292.80

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.