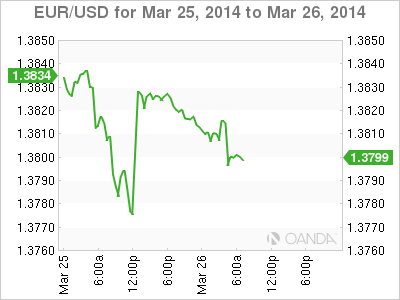

EUR/USD has edged downwards on Wednesday, as the pair trades close just below the 1.38 level. In economic news, German Ifo Business Climate weakened in February but met expectations. In economic news, German Consumer Climate remains at high levels and matched the forecast. In the US, Tuesday's numbers were a mix. Consumer Confidence hit a six-year high, but New Home Sales slipped in February. Wednesday's key release is Core Durable Goods Orders. The markets are expecting a much smaller gain than in the previous release.

German Consumer Climate remains at high levels, posting a second straight reading of 8.5 points, matching the forecast. The indicator has steadily risen, and the last time we saw a stronger reading was back in 2007, before the global economic crisis. German Business Climate also looked sharp in February. Increasing consumer confidence usually translates into more consumer spending, which is a critical component of economic growth.

US numbers were a mix on Tuesday. CB Consumer Confidence jumped to 82.3 points, easily surpassing the estimate of 78.7 points. This was the key indicator's best showing since December 2007. The news wasn't as good from the housing sector, as New Home Sales fell to 440 thousand, down sharply from the January release of 468 thousand. The reading was short of the estimate of 447 thousand. We'll get a look at Pending Home Sales on Thursday.

The US and its European allies have imposed limited sanctions on Russia after its annexation of Crimea, but are holding off on additional measures if Russia does not take further military action. The lack of a tough response from the West reflects divisions within Europe over how strong a stance to take against Moscow. Meanwhile, the Ukraine has signed an association agreement with the EU and is seeking a loan package of up to $20 billion from the IMF. Ukraine's economy has suffered badly after months of political turmoil.

EUR/USD 1.3800 H: 1.3823 L: 1.3790

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.