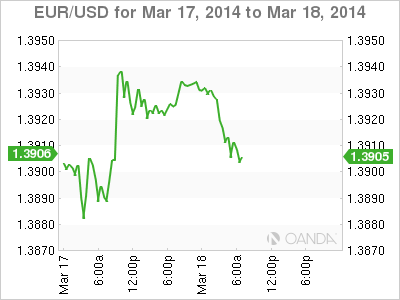

EUR/USD is stable on Tuesday, as the pair trades slightly above the 1.39 line in the European session. The markets are following fast-moving events in the Ukraine, as Crimea has voted to join Russia and the EU and the US have responded with limited sanctions. Turning to economic news, German ZEW Economic Sentiment looked awful, sliding to a ten-month low. The Eurozone indicator also slipped badly. As well, the German Constitutional Court confirmed the legality of the European Stability Mechanism. In the US, there are two major events on the schedule - Core CPI and Building Permits.

Events are moving quickly in the Ukrainian crisis. Voters in Crimea voted overwhelmingly to join Russia in Sunday's referendum, and Russian Prime Minister Putin has recognized Crimea as an independent state, paving the way for annexation. Putin will address a special session of the Russian parliament on Tuesday. The EU and US have responded with targeted sanctions, freezing assets of several high-ranking Russian officials. Additional sanctions are expected, possibly as early as this week.

US releases looked weak on Friday. PPI posted a decline for the first time since November, coming in at -0.1%. The estimate stood at +0.2%. Preliminary UoM Consumer Sentiment dropped below the 80-point level for the first time since November, slipping to 79.9 points. This was short of the estimate of 81.9 points. The weak PPI points to persistently low inflation numbers, which is indicative of an underperforming economy. Recent US numbers have certainly not dazzled, but they should be strong enough for the Federal Reserve to go ahead with another taper of QE. This would be the third trim of the Fed's asset-buying scheme, and would reduce QE to $55 billion per month. These tapers are dollar-positive and mark a vote of confidence in the US economy by the Federal Reserve.

The European Stability Mechanism, which is the Eurozone's bailout fund, was confirmed as legal by the German Federal Constitutional Court on Tuesday. Germany is the biggest contributor to the EUR 970 billion fund. In February, the court deferred a decision on the Outright Monetary Transactions, which is credited with saving weak members of the Eurozone, to the European Court of Justice.

EUR/USD 1.3898 H: 1.3938 L: 1.3890

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.