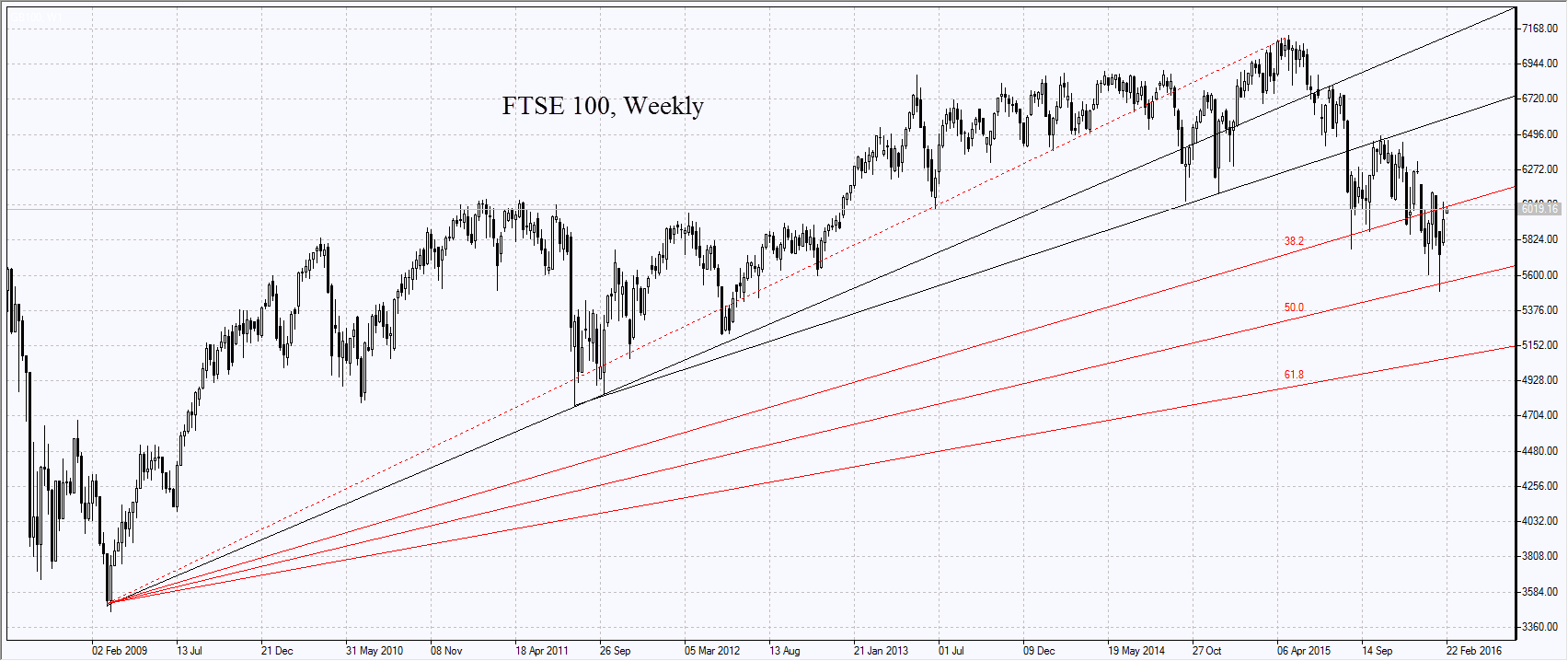

European stock indices are surging on Monday after their fall on Friday. Investors expect the positive performance of the US stock market at the opening. They disregarded the weak industrial PMIs in Eurozone and Germany that came out early in the morning. The Markit's Composite Flash Purchasing Managers' Index (PMI) fell to its lowest in 13 months at 52.7 points. In theory, this raises the further chances of the monetary easing as the result of the next ECB meeting on March 10. No other significant economic data is expected today in EU. The additional positive for the European markets was the more than 5% rise in miners Rio Tinto, Anglo American, Glencore and BHP Billiton stocks thanks to rebounded copper prices. The British FTSE 100 index is rising today amid the falling pound sterling. The weaker currency helps to the competitiveness of the economy. Last week the pan-European Stoxx 600 index showed the record growth this year.

Nikkei is also edging up today on weaker yen following the index’s decline on Friday. The February Manufacturing PMI came out today in the morning in Japan being 50.2 points instead of the expected 52. The falling oil prices on Friday pushed up the air carrier Japan Airlines shares by 5.6%. Mizuho Financial Group has revised up its outlook for Itochu Techno-Solutions Corp. stocks so that they advanced 5.8%. The important Japan’s economic data will come out on Friday morning.

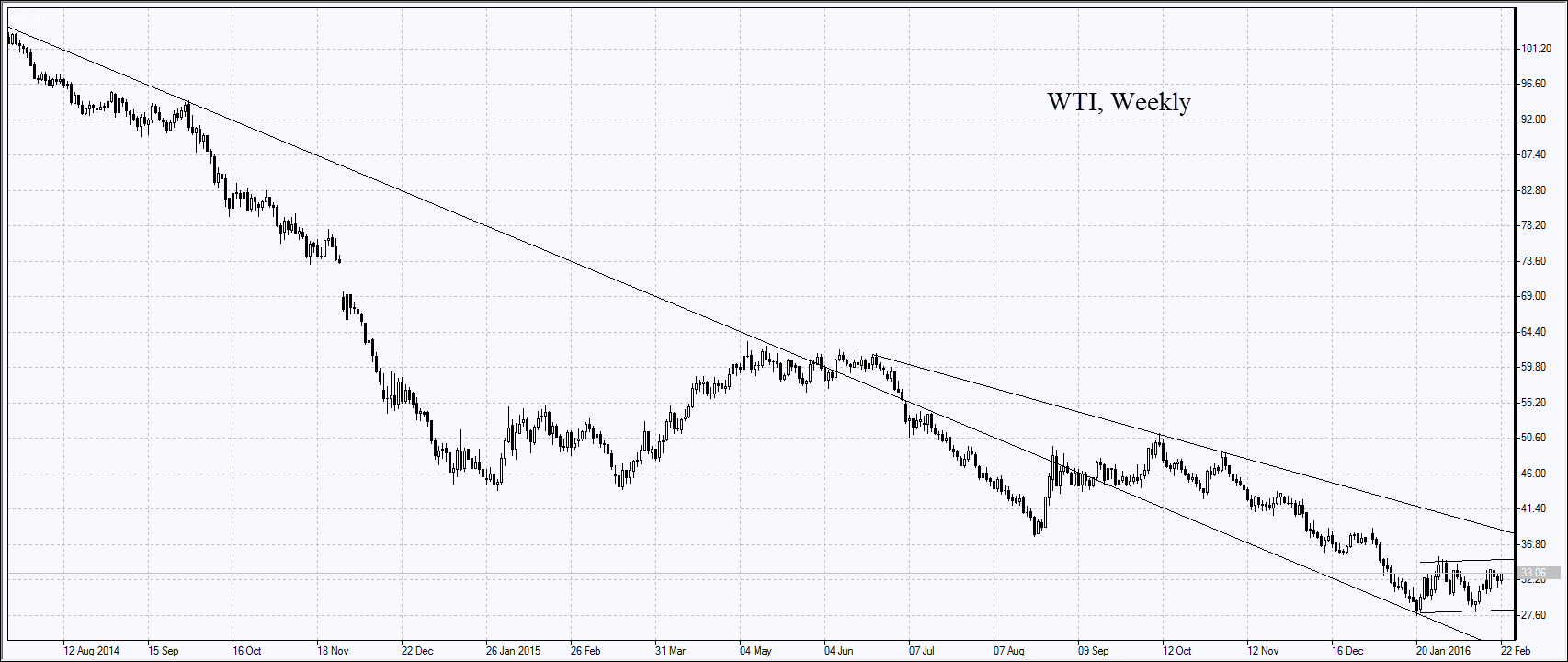

Oil prices are growing today again thanks to the yet another decline in US oil rigs count. The downtrend persists 9 weeks already. Last week another 26 rigs stopped and their current count is only 413 units, according to Baker Hughes. The same week last year the count was 1536. The Goldman Sachs investment bank anticipates the US oil production to contract by 445 thousand barrels a day in 2016 while now the production volumes are 9,135mln barrels a day. The record high oil production volumes were in US in May 2015 at around 9.6mln barrels a day. The shale revolution started in mid-2011. Thanks to the new technologies the gross increase in US oil production was 4mln barrels a day that formed the surplus of that volume in the world markets. It is reducing gradually due to the constant rise in gross demand. The additional positive for oil prices was the China’s plans on Monday to close 1 thousand coal mines with the gross production of 60mln tonnes a year. To meet the energy needs the more active use of residual oil and natural gas are planned. By doing this the China’ authorities take care about the ecology.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.