The global stock markets rose on Wednesday. Basically it was triggered by the corporative information from the U.S. The American Economic Review also known as the Beige Book was also positive.

The motion picture company, Twenty-First Century Fox (shares fell by 6.3%), owned by Rupert Murdoch, made a takeover proposal to its competitor, Time Warner (shares rose by 17.1%), offering $80 billion for the majority ownership. This amount assumes a mark-up of 25% to the market price of Time Warner shares before their yesterday’s increase. Intel - the manufacturer of computer processors presented a good report for the second quarter, saying its shares rose 9.3%. The Bank of America report was weak that caused the decline in its shares by 1.9%. According to new polls, market participants expect a smaller growth of consolidated returns of companies included the S&P 500 index list, by 4.8%. The April forecast was 8.4%. Yesterday's trading volume on the U.S. exchanges was 13.3% higher than the monthly average and amounted to 6.12 billion shares. A part of the S&P 500 index membership presented reports yesterday after the close of trading and another part (14 companies) is expected to report today. In particular, the companies such as: Ebay, Yum! Brands, Google, Philip Morris, Morgan Stanley. The weekly Jobless Clames and the real estate market data for June are expected to be released today at 12-30 CET. The PMI Philadelphia for July is to be published at 14-00CET. In our opinion, the forecasts seem more negative for the stock market.

Yesterday, European stock indexes rose, being under the global trend influence. Shares of troubled Portuguese bank, Banco Espirito Santo skyrocketed by 20% amid negotiations concerning the 1 billion Euros loan payment. Today, the EU markets have prices declined. Market participants believe that the new sanctions against Russia harm the European economy. Let us note that yesterday's EU trade balance for May turned out to be worse than expected. Investors ignored it, but now they think that the new trade restrictions will probably intensify the negative bias. The Eurozone inflation for June is expected to be released today at 9:00 CET. The forecast is negative, it is expected to remain at the level of May and will be 0.5%. This value increases the deflation risk.

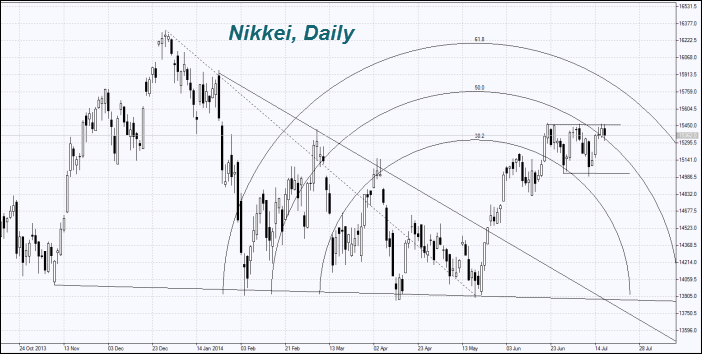

Nikkei rose on Wednesday to the upper limit of its neutral trend and it is lowering today. According to the Japanese Ministry of Finance weekly report, non-residents reduced their purchases on shares of local companies. Since the end of next week, no critical information is expected from Japan. The prices will most likely move along with other global markets.

The Gold price rose due to increasing demand. Its import to India jumped by 65% to $3.12 billion in June compared to the same month of last year being around 8% of the total Indian imports.

The Oil prices increased due to significant decline of the U.S. reserves by 7.53 million barrels last week. More than it was expected. An additional factor of the price growth were new sanctions against Russia, the third largest Oil producer in the world. Besides it, the Libyan government reported a launching delay of two oil export terminals with capacity of 500 thousand barrels per day until August.

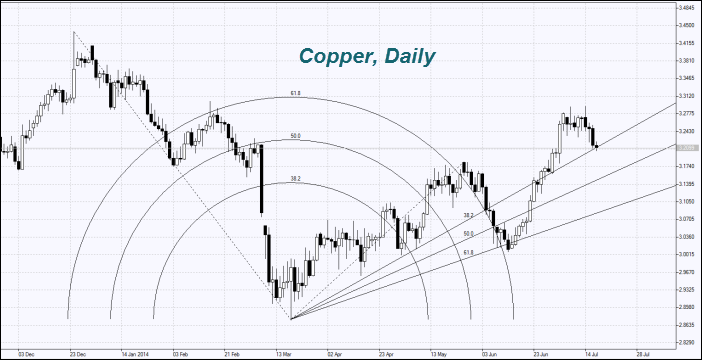

The Copper prices decreased significantly. The Chinese construction company, Huatong Road & Bridge Group announced a possible default on its bonds. China consumes 40% of this metal in the world. The Indonesian Government claimed the U.S. company, Newmont Mining for resumption of copper exports and higher duties. Recall that the metal supply out of the country was stopped six months ago. Otherwise, the Government threatened to lend the license for the copper production to the state-owned company.

The grain prises grew due to fears of drought in the U.S. and the dockers strike in Argentina. This country is the third largest exporter of soybeans and corn in the world. The Chicago Stock Exchange announced the purchase of grain futures by commodity investment funds that also had a positive impact on the prices.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold price turns red below $2,320 amid renewed US dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is Securities and Exchange Commission (SEC) filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.