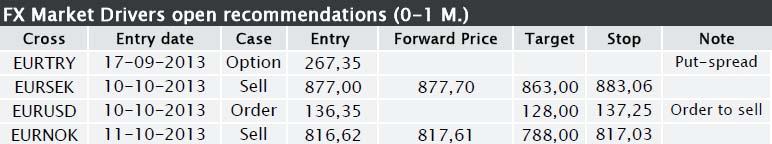

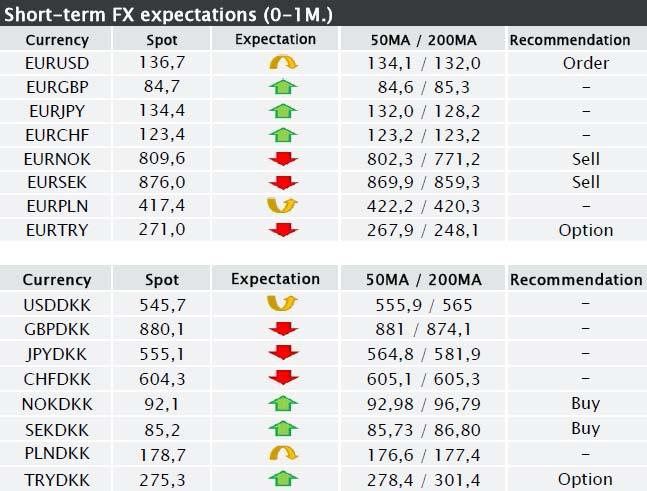

Overall recommendations

Short-term

- The winners after the political deadlock of USD are the USD-related EM currencies. Particularly MXN.

- Among the G10 currencies, NOK and AUD are probably the ones investors should focus on.

- As a short-term funding currency, JPY and CHF will offer the best sharpe ratio.

Long-term

- In the long term, USD is cheap.

Review

The past 24 hours have been characterised by consolidation.

- USD has strengthened against majors, and particularly USDJPY and EURUSD were affected.

- Rising momentum in Scandies.

- The yield levels among majors are more or less unchanged.

- Crude oil (WTI) fell to a level below USD 100 for the first time since July.

Focus today will be on the release of non-farm payroll data at 14:30.

An increase of 180,000 new jobs is expected. If the job report show a figure below 165,000, there is a big risk that the market will have a negative interpretation of the report. In that case, market players will allow for a higher probability that the Fed will not begin its scaling down of QE until some later time in 2014, which would again put downward pressure on US yields, and hence result in negative pressure on USD.

If this risk scenario materialises, there is a definite risk that EURUSD will break through the top at 137.11 seen in February, which would send USD considerably lower.

A figure between 165,000 and 200,000 would only result in minor intraday fluctuations depending on the positioning prior to the release.

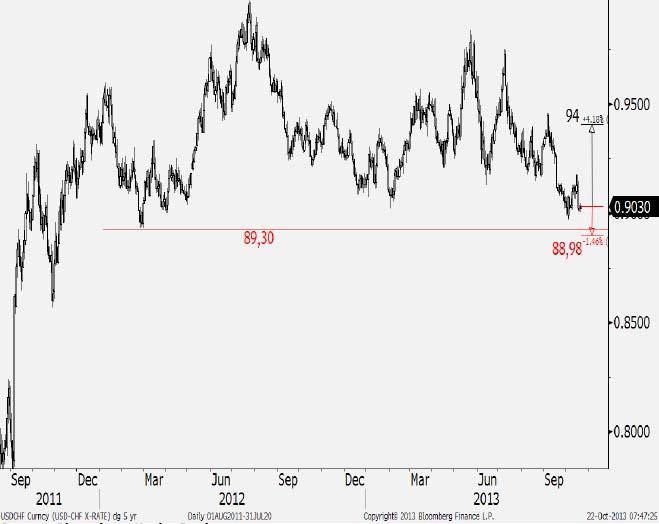

Today's chart

For the second time in a few months, there are good opportunities of picking up various currencies against CHF. It is assessed that there is a good risk-reward when buying USD, GBP, NOK, SEK, AUD, MXN against CHF in the short to the medium term.

The chart illustrates a purchase strategy as well as risk-reward in USDCHF.

EURUSD (ORDER): We recommend a sell order at 136.35 with a close stop loss at 137.25.

Monday's chart showed strong resistance in EURUSD at the level of 137.11.

If we see a turnaround from this level, the road is paved for a movement down to 134.00 - 134.65 as a minimum. We recommend that already at 134.90, investors adjust stops down to 135.55.

EURUSD

In the short term, the following levels are of importance:

Support: 134.50, 132.05 (200MA). 130.21 and subsequently 127.50.

Resistance: 137.11 Then 140.00.

EUR/NOK(SELL): We recommend investors to sell EURNOK. We have adjusted stop/loss to 817.03.

As EUR/PLN falls, we will continue to lower the S/L level.

Norges Bank will have its interest-rate meeting on Thursday. It may be interesting and will undoubtedly affect NOK.

We maintain our recommended sell (for the short term (0-1M) as well as for the long term (1-6M)).

NOK has been under pressure lately, among other things due to low liquidity - when trading picks up again, we expect to see NOK strengthen.

EURNOK

EURSEK (SELL): We recommend that investors sell EURSEK with S/L at 883.06.

As in Norway, there will also be an interest rate meeting in Sweden on Thursday. No major adjustments are expected on the part of the Riksbank. The interest rate path of the Riksbank matches the expectations of the interest-rate market more or less.

As yields in the US and the UK and the euro zone fall back, we see growing momentum in demand for SEK. Particularly hedge funds are again taking advantage of the increasing interest rate advantage as well as the relatively low level.

The interest rate meeting and the release of producer prices on Thursday may be events triggering a new round of SEK purchases.

When EURSEK closes below 873, we expect further increasing momentum where 860 will offer the first major level of resistance.

Support: 859-860 (200 MA)

Resistance: 883 and 890.

EURTRY (BUY put spread): No new recommendation. The current recommendation expires on 24/10/2013.

Our original recommendation is very much out of the money. Instead investors may consider buying a 268 put expiring after the interest rate meeting of the CBRT on Wednesday. Ask your adviser about the price.

Today’s events:

10:00 Poland: Retail sales. A solid increase is expected. (Y/Y 4.6%; previously: 3.4 %)

14:30 The US: Non-Farm-Payroll. Release of the delayed job report.

The delayed US economic indicators will be released one by one over this week.

The market value of the economic indicators will, however, have fallen as the indicators will be 'polluted' by the shutdown of government.

Chart of the day: USDCHF

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank does not assume any responsibility for the correctness of the material nor for transactions made on the basis of the information or the estimates of the analysis. The estimates and recommendations of the analysis may be changed without notice. The analysis is for the personal use of Jyske Bank's customers and may not be copied.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.