Key Highlights

-

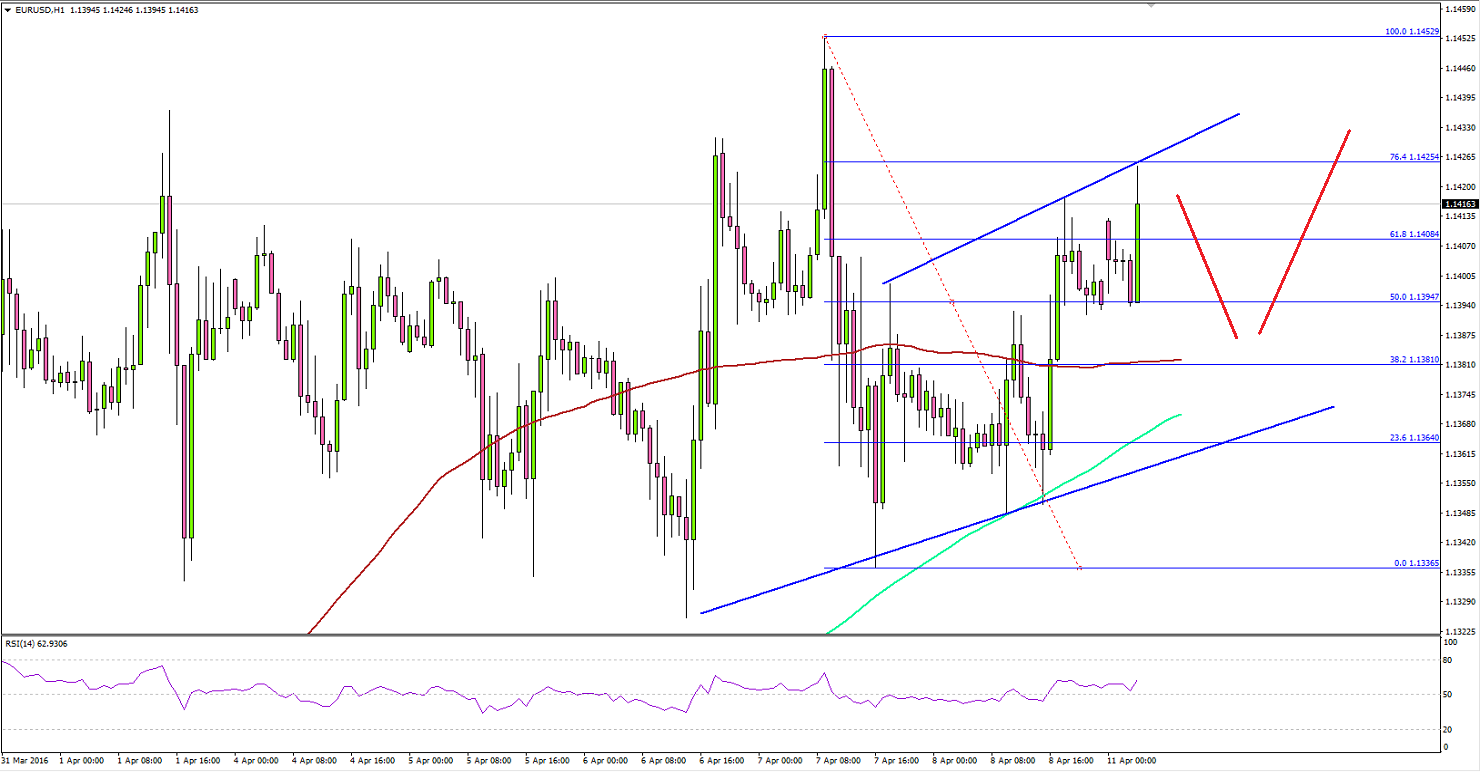

Euro looks like trading in a range against the US Dollar, but it may break higher in the short term.

-

There are a couple of trend lines formed on the hourly chart of the EURUSD pair, which could ignite the next move.

-

Chinese Consumer Price Index released by the National Bureau of Statistics of China posted a decline of 0.4% in March 2016, more than the forecast of -0.3%.

-

Chinese Producer Price Index decreased by 4.3%, a bit less than the forecast of -4.6%.

EURUSD Technical Analysis

The Euro closed the last week above the 1.1350 level against the US Dollar and traded mostly in a range. There are a couple of trend lines formed on the hourly chart of the EURUSD pair, which may act as a catalyst for the next move. One is on the upside, acting as a resistance and another on the downside to act as a support.

The pair is well above the 100 and 200 simple moving average on the same chart, which is a positive sign for the Euro bulls in the short term.

If the pair manage to break the upper trend line resistance, then a move towards the 1.1450 level is possible moving ahead.

Italian Industrial Output

Later today, the Italian Industrial Output that shows the volume of production of Italian industries such as factories and manufacturing will be released by the National Institute of Statistics.

It is a low risk event, but there is a chance of an impact on the Euro since there are no other economic releases lined up.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.