Key Highlights

Japanese yen was seen consolidating against major currencies after the industrial production report.

Japanese Industrial Production released by the Ministry of Economy, Trade and Industry posted a decline of 3.4% in February 2014, which is lower than the last gain of 3.7%.

USDJPY trading above the all-important 119.00 support area where sellers might struggle if the pair moves lower.

Japanese Industrial Production

Earlier today, the Japanese Industrial Production, which gauges the outputs of the Japanese factories and mines and is a major indicator of strength in the manufacturing sector was released by the Ministry of Economy, Trade and Industry. The outcome was on the disappointing side, as the Japanese industrial production registered a decline of 3.4% in February 2014, which was negative when compared to the preceding increase of 3.7%.

Technical Analysis

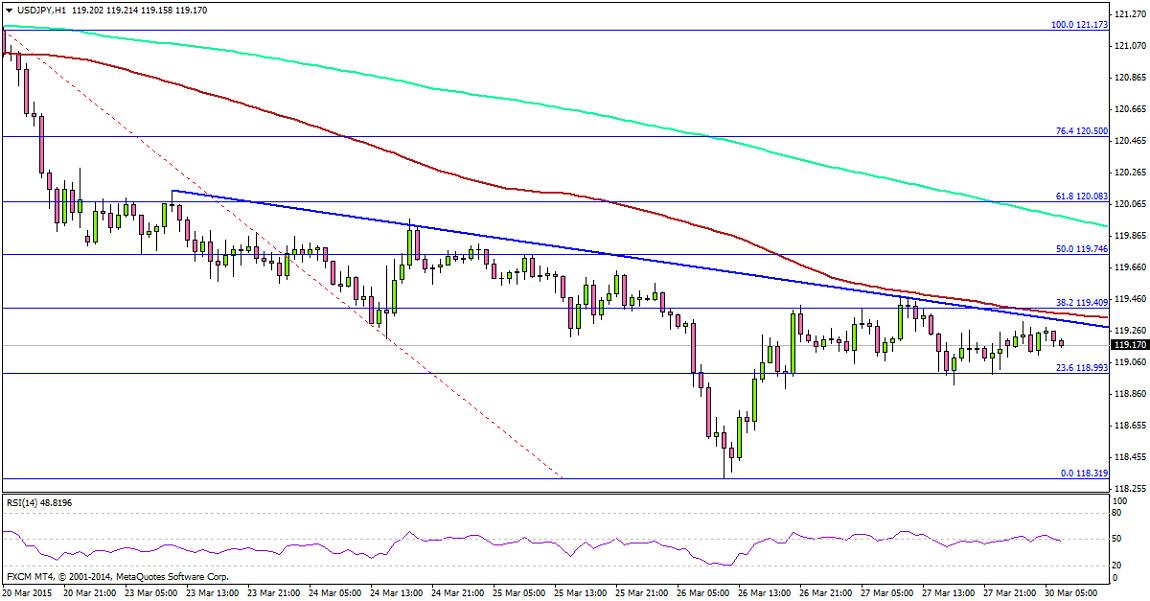

The US dollar buyers continued to gain strength against the Japanese yen, but every time the USDJPY pair trades higher it finds sellers. There is a critical bearish trend line formed on the hourly chart of the USDJPY pair, which is acting as a resistance for the pair on the upside. Moreover, the 100 hour simple moving average is also aligned around with the same trend line.

Furthermore, the 38.2% fib retracement level of the last leg from the 121.17 high to 118.31 low is also positioned just above the highlighted trend line. So, we might say that there is a major barrier forming around the 119.40 area where the US dollar buyers might struggle and the pair could find it tough to break higher as long as the trend line is intact. Only a break and close above the same might take the pair towards the 50% fib retracement level.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.