Analysis for October 19th, 2015

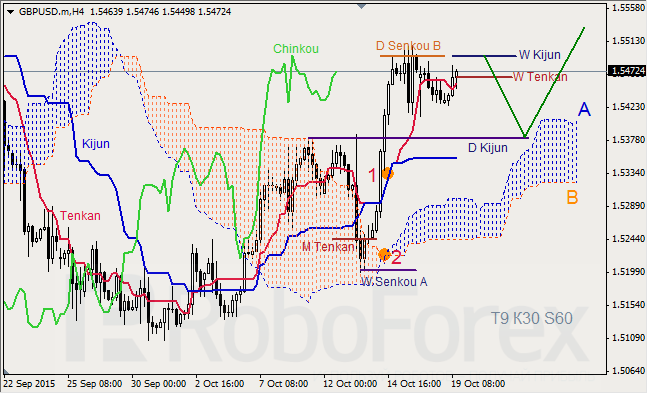

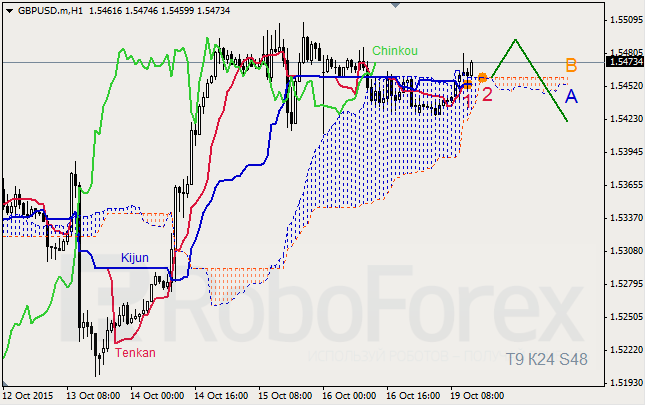

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD, Time Frame H4. Indicator signals: Tenkan-Sen and Kijun-Sen are still influenced by “Golden Cross” (1). Ichimoku Cloud is heading up (2), Chinkou Lagging Span is above the chart, and the price is on Tenkan-Sen. Short-term forecast: we can expect resistance from W Tenkan-Sen – W Kijun-Sen – D Senkou Span B, and support from D Kijun-Sen.

GBPUSD, Time Frame H1. Indicator signals: Tenkan-Sen and Kijun-Sen are very close to each other inside Kumo Cloud (1). Ichimoku Cloud is going down (2), Chinkou Lagging Span is above the chart, and the price is near the cloud’s upper border. Short-term forecast: we can expect support from Senkou Spans A and B.

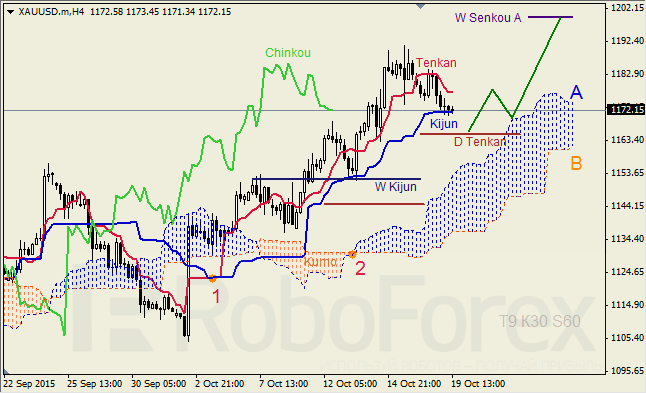

XAUUSD, “Gold vs US Dollar”

XAUUSD, Time Frame H4. Indicator signals: Tenkan-Sen and Kijun-Sen are still influenced by “Golden Cross” (1). Chinkou Lagging Span is close to the chart, Ichimoku Cloud is moving upwards (2), and the price is on Kijun-Sen. Short‑term forecast: we can expect support from D Tenkan-Sen and the cloud’s upper border, and growth of the price up to W Senkou Span A.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.