Analysis for September 3rd, 2015

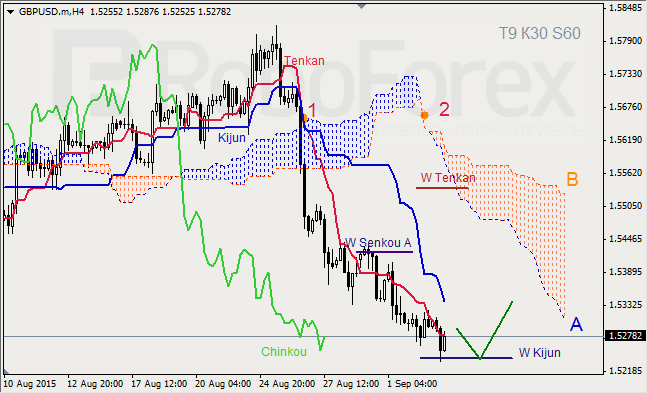

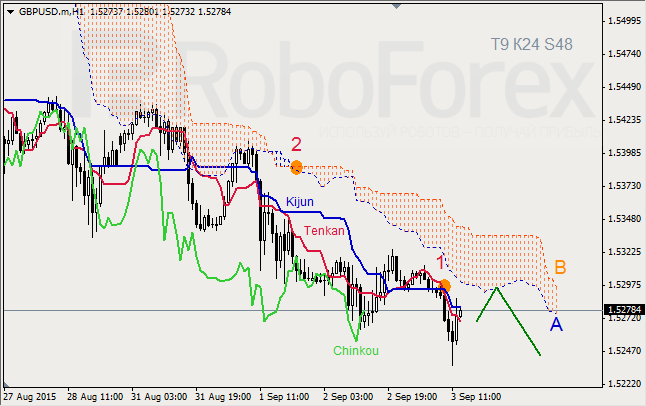

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD, Time Frame H4. Indicator signals: Tenkan-Sen and Kijun-Sen are still influenced by “Dead Cross” (1); Kijun-Sen and Senkou Span A are directed downwards. Chinkou Lagging Span is below the chart; Ichimoku Cloud is going down (2). Short-term forecast: we can expect resistance from Tenkan-Sen and support from W Kijun-Sen.

GBPUSD, Time Frame H1. Indicator signals: Tenkan-Sen and Kijun-Sen intersected below Kumo Cloud again and formed “Dead Cross” (1); Tenkan-Sen and Senkou Span B are directed downwards. Ichimoku Cloud is going down (2); Chinkou Lagging Span is on the chart, and the price is inside a narrow channel between Tenkan-Sen and Kijun-Sen. Short-term forecast: we can expect resistance from the cloud’s lower border, and a further decline of the price.

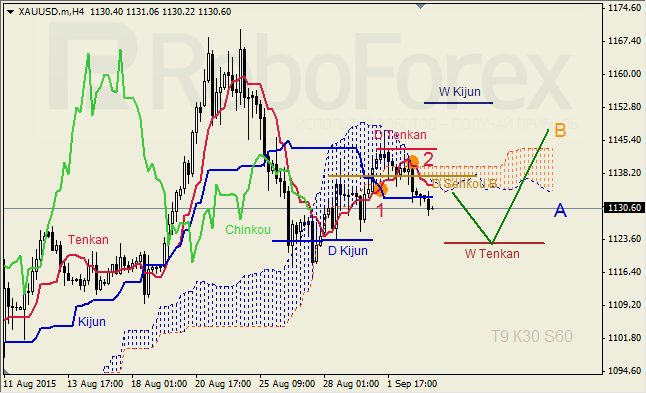

XAUUSD, “Gold vs US Dollar”

XAUUSD, Time Frame H4. Indicator signals: Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1), nut hey are getting closer to each other below Kumo Cloud. Chinkou Lagging Span is close to the chart, Ichimoku Cloud is moving downwards and widening (2), and the price is moving towards W Tenkan-Sen. Short‑term forecast: we can expect support from D Kijun-Sen and W Tenkan-Sen.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.