Analysis for October 22nd, 2014

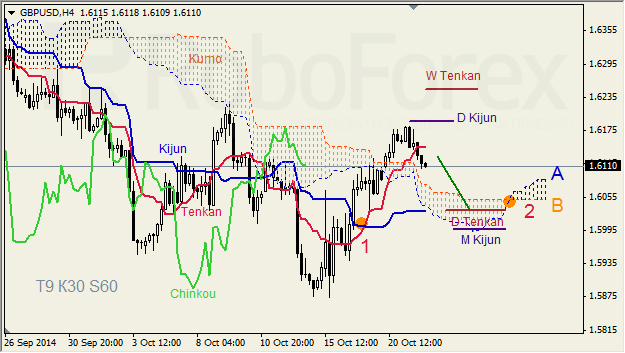

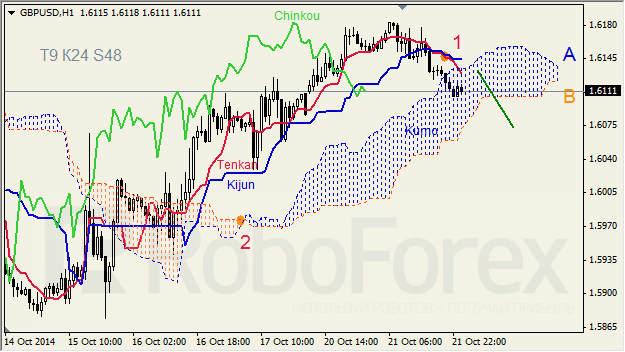

GBP USD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4 – Indicator signals: Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1); the price is “returning to the cloud’s border after breaking it”. Chinkou Lagging Span is above the chart, Kumo Cloud is going up (2), and the price is between Tenkan-Sen and Kijun-Sen. Short term forecast: we can expect support from D Tenkan-Sen.

GBP USD, Time Frame H1. Tenkan-Sen and Kijun-Sen formed “Dead Cross” (1). Chinkou Lagging Span is below the chart, Kumo Cloud is getting narrower, but still going up (2), and the price is inside the cloud. Short term forecast: we can expect resistance from Tenkan-Sen, and decline of the price.

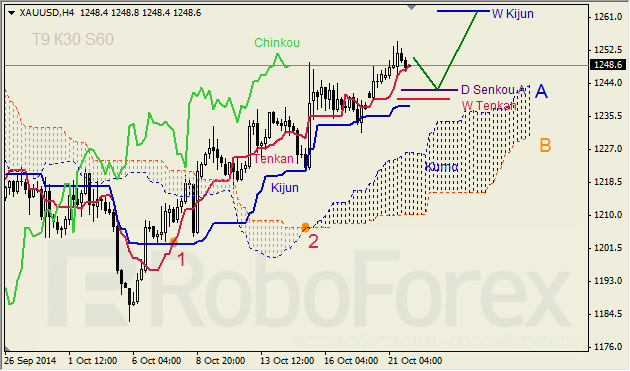

XAU USD, “Gold vs US Dollar”

XAU USD, Time Frame H4: Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1); all lines except Kijun-Sen are directed upwards. Chinkou Lagging Span is above the chart, Kumo Cloud is going up (2), and the price is inside D Kumo. Short-term forecast: we can expect support from D Senkou Span A, and growth of the price inside D Kumo towards its upper border.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.