Analysis for June 5th, 2014

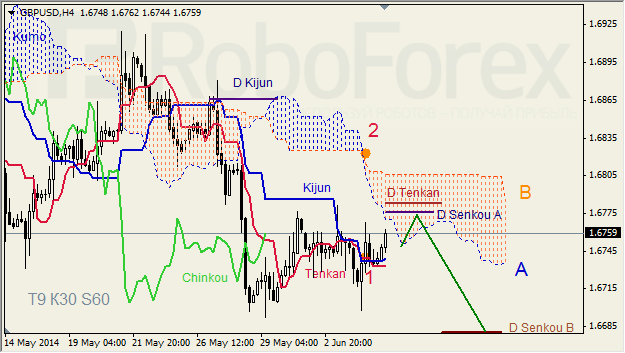

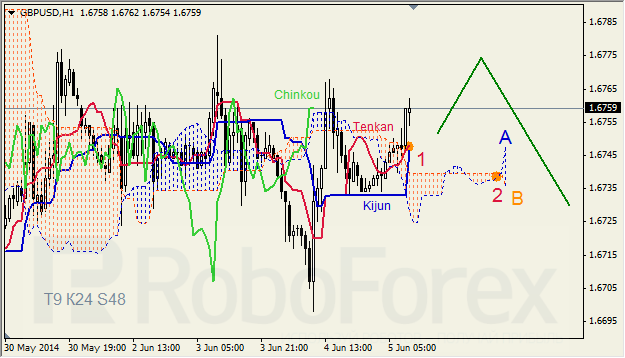

GBPUSD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are forming “Dead Cross” below Kumo (1). Ichimoku Cloud is going down, and Chinkou Lagging Span is above the chart. Short‑term forecast: we can expect resistance from D Senkou Span A – D Tenkan-Sen, and decline of the price.

GBPUSD, Time Frame H1. Tenkan-Sen and Kijun-Sen are close to each other above Kumo (1); all lines except Senkou Span B are directed upwards. Ichimoku Cloud is going up, and Chinkou Lagging Span is above the chart. Short‑term forecast: we can expect support from Tenkan-Sen – Kijun-Sen, and growth of the price.

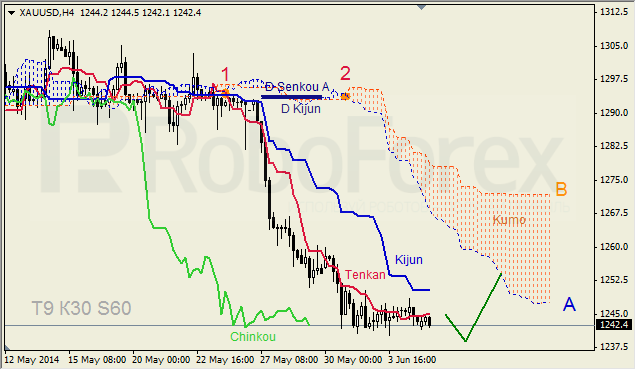

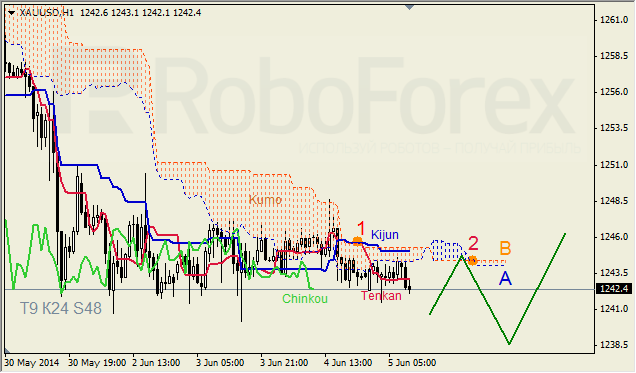

XAUUSD, “Gold vs US Dollar”

XAUUSD, Time Frame H4. Tenkan-Sen and Kijun-Sen are influenced by “Dead Cross” (1). Ichimoku Cloud is going down (2), Chinkou Lagging Span is close to the chart, and the price is below the lines. Short-term forecast: we can expect decline of the price, and then growth towards Kumo’s lower border.

XAUUSD, Time Frame H1. Tenkan-Sen and Kijun-Sen formed “Dead Cross” (1). Ichimoku Cloud is going down and almost closed, Chinkou Lagging Span is below the chart. Short‑term forecast: we can expect resistance from Senkou Spans A and B, and then attempts of the price to stay above Kumo.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.