Analysis for April 9th, 2014

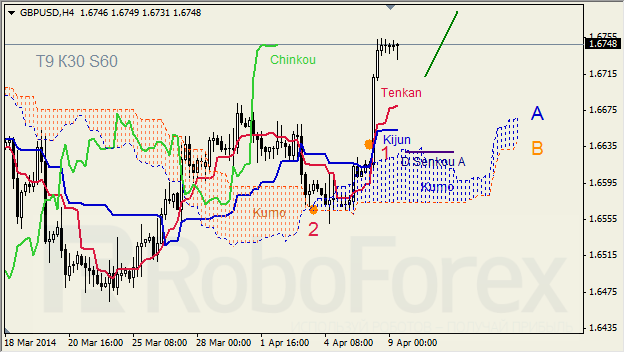

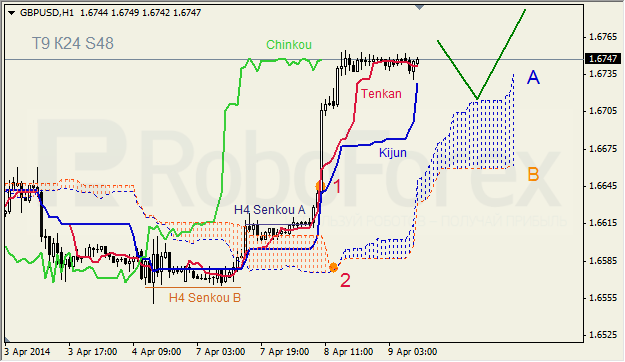

GBP USD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1); Tenkan-Sen, Senkou Spans A and B are directed upwards. Ichimoku Cloud is going up (2), Chinkou Lagging Span is above the chart, and the price above the lines. Short‑term forecast: we can expect support from Tenkan-Sen, and growth of the price.

GBP USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are close to each other above Kumo Cloud (1); Kijun-Sen and Senkou Span A are directed upwards. Ichimoku Cloud is going up (2), Chinkou Lagging Span is above the chart, and the price is on Tenkan-Sen. Short‑term forecast: we can expect support from Senkou Span A, and growth of the price.

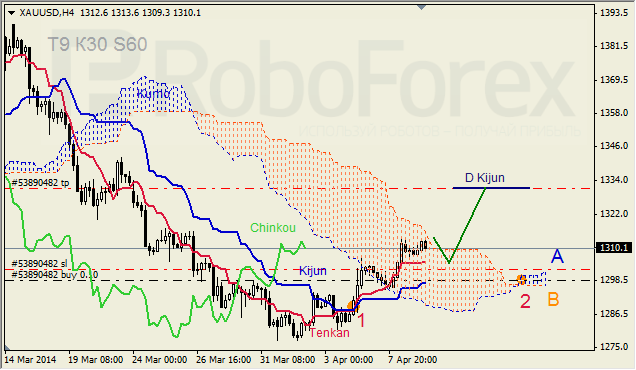

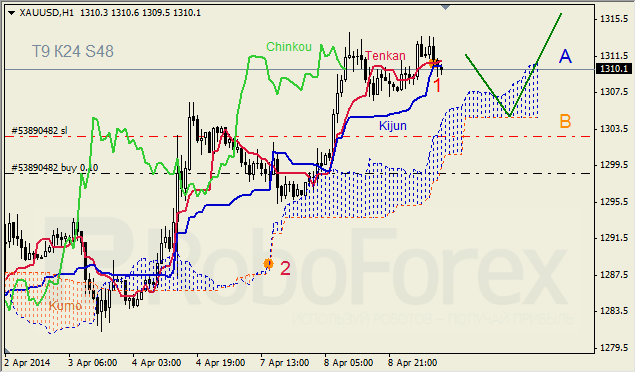

XAU USD, “Gold vs US Dollar”

XAU USD, Time Frame H4. Tenkan-Sen and Kijun-Sen formed “Golden Cross” below Kumo Cloud (1). Ichimoku Cloud is going up (2), Chinkou Lagging Span is above the chart, and the price is near Kumo’s upper border. Short-term forecast: we can expect resistance from Senkou Span B, support from Tenkan-Sen, and attempts of the price to stay above Kumo.

XAU USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are very close to each other above Kumo Cloud (1). Ichimoku Cloud is going up (2), and Chinkou Lagging Span is on the chart. Short‑term forecast: we can expect support from Senkou Span B, and growth of the price.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

US inflation data in the market purview

With next week's pivotal US inflation data looming, we're witnessing a stall in stock market momentum and an uptick in US Treasury yields. This shift comes amid murmurs of hawkish sentiment from Fed speak. Indeed the mind games intensify even further as investors cling to their rate cut hopes.