Analysis for February 11th, 2014

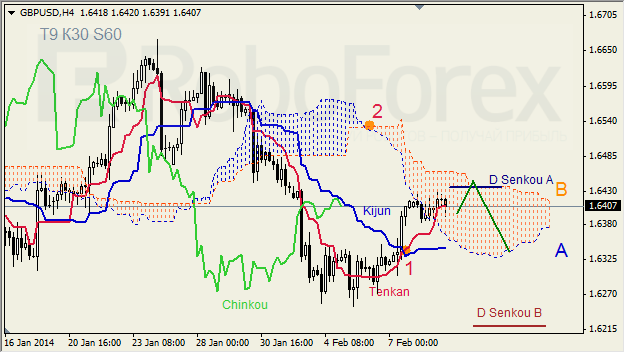

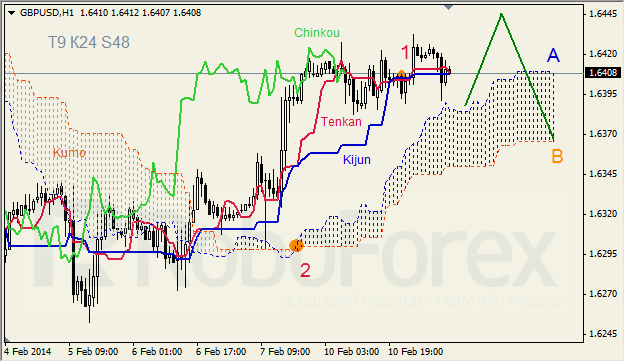

GBP USD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are forming “Golden Cross” (1) below Kumo Cloud; Tenkan-Sen is directed upwards. Ichimoku Cloud is narrow (2), Chinkou Lagging Span is above the chart. Short‑term forecast: we can expect growth of the price up to D Senkou Span A.

GBP USD, Time Frame H1. Tenkan-Sen and Kijun-Sen intersected above Kumo Cloud and formed “Golden Cross” (1); right now, they are very close to each other again. Ichimoku Cloud is going up (2), Chinkou Lagging Span is on the chart. Short‑term forecast: we can expect support from Senkou Span A, and growth of the price.

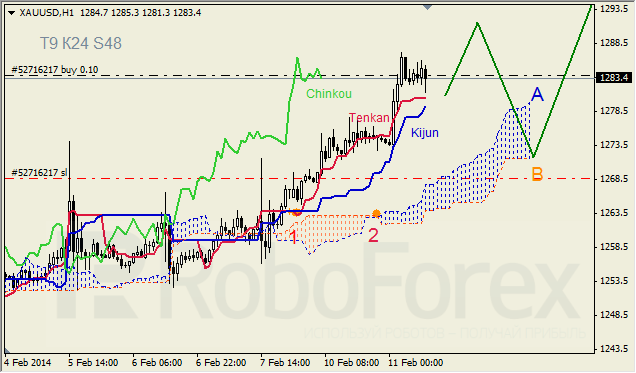

XAU USD, “Gold vs US Dollar”

XAU USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1). Ichimoku Cloud is going up (2); Chinkou Lagging Span is above the chart. Short-term forecast: we can expect support from D Senkou Span B.

XAU USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1). Ichimoku Cloud is going up (2), Chinkou Lagging Span is above the chart, and the price is above the lines. Short‑term forecast: we can expect support from Tenkan-Sen, and growth of the price.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.