It was an eerily quite North American trading session yesterday, influenced by a number of the major trading centers engaged in holiday activities.

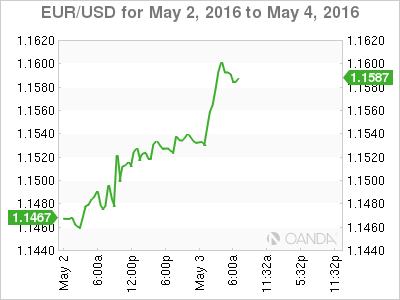

In North America, market volumes were reported on the light side, and this despite U.S. factory activity slipping in April. The same cannot be said for early trading ahead of the U.S open – the dollar continues its relentless quest to underperform across the board, falling again against all of its major trading partners. The perceived delay in the timing of the next Fed rate hike remains the main catalyst for the greenbacks decline.

Yesterday, U.S ISM manufacturing index fell more than expected, easing to 50.8 in April from 51.8 in March. New orders dropped to 55.8 from 58.3, while prices paid index rose to 59.0 from 51.5.

Overall, the headline print is not great news, but it has remained in expansion territory for two-consecutive months after spending five-months in contraction. For the neutral, a tentative sign of growth and optimism in the U.S manufacturing sector, an area that’s been beaten up by low oil prices and a stronger dollar.

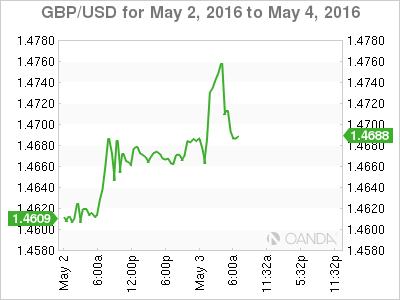

1. Pound erases all of 2016-dollar losses

In overnight trading, the magnitude of the ‘mighty’ dollar’s demise can be highlighted by the recent movements of the pound. In European mid-morning trading, sterling climbed to its highest level for this year outright, again putting the pound (£1.4760) briefly back into positive territory against the greenback for the year.

Sterling was up by as much as +0.70%, before weak PMI (49.2 vs. 51.3) data caused sterling to pare some of its earlier gains. The dollar is weaker across the board, by around -0.65% against the EUR (€1.1591) and -0.5% against the yen (¥105.75). Expect dealers debating of when and where the Bank of Japan (BoJ) could possibly intervene to curb the “one-sidedness” of the yen moves to only grow louder.

Sterling bulls still have Brexit to deal with!

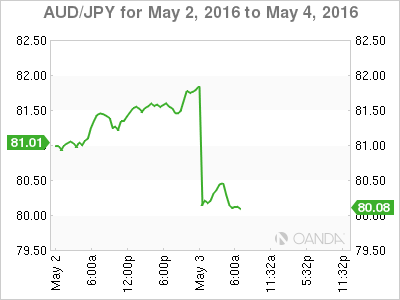

2. Reserve Bank of Australia (RBA) sides with money markets

In its monetary policy decision overnight, the RBA decided that the best policy was to implement further easing, side stepping market analysts consensus expecting a rate hold.

Governor Stevens and company noted that the reduced risks in housing inflation allowed them to focus on making economic recovery more sustainable in deciding to cut rates by -25bps to new record low of +1.75%.

The RBA noted that Aussie labor indicators have become more “mixed,” and that economic growth has become more “moderate.” This afforded Aussie policy makers the latitude to make the surprise overnight rate move.

Latest multi-year lows in inflation CPI figures were also deemed decisive in the RBA’s decision. Aussie policy makers noted that the “price data were unexpectedly low, and coupled with cost pressures overseas, would risk a lower outlook for inflation than previously forecast.”

Naturally, the AUD has underperformed across the board, down -1.69% outright to A$0.7573.

3. EU sees weaker regional growth on back of China

This morning a group of economists at the European Commission has warned that the economic slowdown in China and other emerging markets, geopolitical tensions and uncertainty ahead of the U.K. referendum on EU membership could weigh on the bloc’s economy.

The EU’s economists also cautioned that the strength of factors that have been supporting growth in the region (low oil prices and weak EUR), could start to fade, while fundamental problems (high levels of private debt and unemployment) in many of the bloc’s economies could continue to hold back the economic recovery.

The commission have again revised the EU’s growth forecasts. They foresee the 19-country eurozone growing +1.6% this year, down from the +1.7% expansion seen in February. In 2017, the region is expected to expand by +1.8% vs. +1.9%.

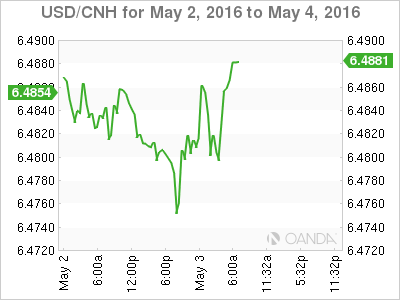

4. Weak Chinese data pressures equities

Another downbeat reading on Chinese manufacturing is bringing concerns about the world’s second-largest economy back to the surface. This has again got “risk on” trading strategies under pressure.

Overnight, China’s April Caixin PMI manufacturing (unofficial) has retreated, recording its fourteenth consecutive month of contraction (49.4 vs. 49.8) thanks mostly to sluggish new orders and soft foreign demand for Chinese goods. The disappointing headline print matches the slight retreat in the “official” figures released over the weekend.

Local analysts indicate that their economy lacks a solid foundation for recovery, recommending that the Chinese government continue to closely monitor for risks of a further economic downturn.

5. ECB: Investors Are Profiting From Pre-Release U.S Data

Researchers from the European Central Bank (ECB) on both sides of the Atlantic said yesterday that they have “strong evidence” that investors are profiting on U.S. economic data before it is released.

In a study examining 21 U.S. economic data releases, a third of the cases saw the futures markets drifting in the correct direction a half hour before the official headline release. The report estimates that approximately $20m a year has been made on pre-release futures trading (U.S home sales, preliminary GDP and industrial production) since 2008.

The researches are calling for an investigation to determine the source of this “informed” trading.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY crashes toward 156.00, Japanese intervention in play?

Having briefly recaptured 160.00, USD/JPY came under intense selling and sank toward 156.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.