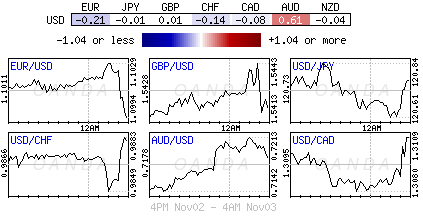

Currently, many of the major currency pairs remain confined to a tight trading range, and owing to the lack of intraday volatility, investors are required to be fleet of foot when looking for meaningful returns. Last month saw the return of the “carry trade”(+4.7% in Oct. vs. -8.3% in August when China devalued the yuan). With the possibility for even more central-bank stimulus in Europe and Japan, looser monetary policy will continue to support the markets demand for riskier assets (EM pairs favored PLN, RUB, TRY, ZAR, IDR) until proven wrong.

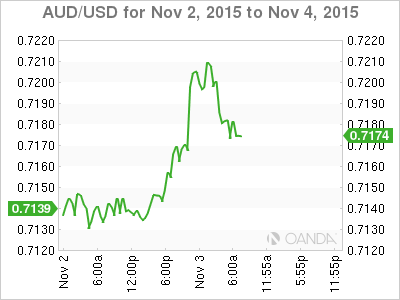

Antipodean pairs go it alone: In the overnight session it was the Reserve Bank of Australia’s (RBA) turn to disappoint – only on policy, not on price movement. The AUD (A$0.7180) has managed to push higher despite the markets muted risk appetite ahead of other rate announcements (BoE Thursday) and this week’s U.S jobs report (NFP Friday). The RBA have wrong-footed the bears by not cutting interest rates (+2%), and perhaps more surprisingly, policy makers do not appear to be in any rush to ease again any time soon. Prior to the meeting, softer Q3 CPI and the decision by financial lenders to raise mortgage rates to offset higher capital requirements had the market speculating further easing. Instead, Governor Stevens acknowledged lower inflation to stand pat, adding that property-lending conditions are still “accommodative.” Money markets have now lengthened their odds on a year-end move by the RBA, while continuing to price in a full -25bps cut in Q2/2016. For the Kiwi dollar (October recorded the largest monthly gain in two-years N$0.6712), investors will want to focus on today’s global dairy trade auction (GDT) as it has the possibility to put the NZD under pressure. Weaker dairy prices will have the market upping their bets for another -25bps cut by the RBNZ next month.

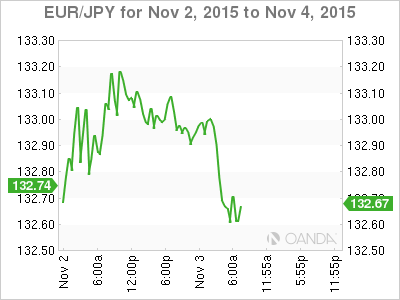

Growing skepticism over BoJ’s forward guidance: Despite Tokyo markets being closed for the holiday, gaining traction is a Nikkei report that suggests analysts are increasingly skeptical that the Bank of Japan’s (BoJ) Governor Kuroda will “not” be able to achieve the bank’s +2% CPI target by the end of his term in 2018. This is well beyond the H2 of 2016 timeframe expressed by Japanese policy makers last week. Putting the yen (¥120.87) under further pressure is Japan’s Center for Economic Research (JCER) suggesting that last Septembers GDP has fallen into contraction for the first time in four-months, driven by a -0.5% shortfall in consumer spending.

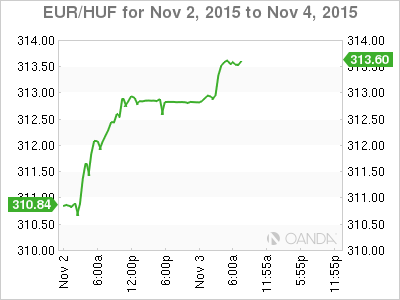

Carry trade focus eyes CEE currencies: This morning, the HUF (€313.73) has managed to fall to a new monthly low on concerns that lending incentives by MNB (Hungarian central bank) could be announced as soon as today. The market is anticipating that the bank will make an announcement to extend its funding program for cheap lending to companies well into next-year, and this despite an earlier pledge to phase out the program. Obviously, any surprises to the contrary could end up hurting the bears during the North American session.

Not all rosy for U.S manufacturing: Data yesterday’s showed that U.S ISM manufacturing PMI (nationally) expanded at its slowest pace in nearly two-years for October. In part because of rate divergence, U.S manufacturing is expected to come under pressure from a stronger dollar and a weaker global economy. With energy markets continuing to struggle, these effects are now beginning to bleed into other areas, thus providing a distinct loss of growth momentum in recent months for the U.S. The dollar initially weakened slightly against G7 pairs, but with the employment component improving has managed to limit some of the “big” dollar’s losses. Over the coming weeks, any more data showing that U.S growth is holding up against overseas weakness should boost the Fed’s case to tighten monetary policy next month (Dec. 16), and reason why short term yields are expected to continue to back up from their historical lows. This week concludes with Friday’s granddaddy of economic indicators, U.S non-farm payroll (NFP). With the Fed so data dependent, October’s jobs report will also go along way in convincing investors whether a December rate hike is a ‘real’ possibility.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.