Investors to ‘wait and see’ Sunday’s Greek Referendum outcome

Eurozone business activity hits four-year high

U.K services shakes election blues

China continues to see red

It’s only natural that this weekend’s Independence Day celebrations stateside and Sunday’s Greek referendum would discourage any aggressive market participation.

Expect many investors to continue to adopt the “wait and see'” approach, especially after the market shenanigan’s that occurred on the Asian open last weekend when a supposed eleventh hour deal between Greece and its main three creditors was anticipated. The market does not want to be caught aggressively offside on the too close to call Greek referendum results. Latest surveys imply a coin toss outcome.

Last weekend, the Greek government was happy to shift the decision responsibility to the country’s electorate via a referendum. This jaded market has been trading to lip service ever since. Either way, Capital Market dealers are anticipating a price gap opening, and depending on whom you listen too, market moves will vary accordingly, at least until the market has fully digested the implications of the Greek vote.

The current polls are showing that Greece’s citizens were split on the bailout referendum with Greek PM Tsipras continuing to sell a “No” as a chance for a better deal. Safe haven flow trading is anticipated to dominate if the outcome of the vote is seen as moving towards a Grexit possibility. The too close to call outcome is discouraging many from making any large bets heading into the weekend.

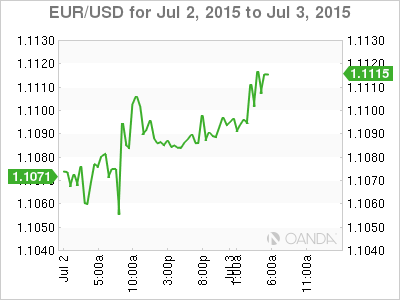

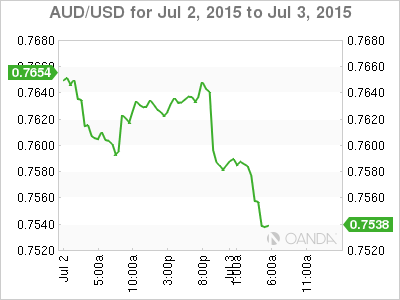

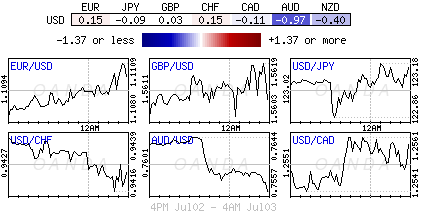

Due to the holiday-shortened week in the U.S, the mighty dollar is happily treading water against its G10 currency counterparts while rallying against the Aussie dollar, which has sank to a new three-month low in the overnight session on weak domestic retail sales (+0.3% vs. +0.5% expected) and a five-month low China PMI services print (51.8).

Euro-Area Economy Shakes Off Greek Shackles on Stimulus

Eurozone business activity managed to hit a four-year high in Q2 earlier this morning, which suggests that Greece’s woes have yet to impair the regions growth possibilities. The composite PMI for the region was revised up to 54.2 from its flash June estimate of 54.1. The details indicate that the improvement is being led by Spain and Ireland, with obvious ongoing support from Europe’s powerhouse Germany. Perhaps more importantly, recoveries are building amongst some of the troubled members – Italy and France.

Other data tentatively supporting the ‘single’ currency this morning (€1.1120), and despite backward looking is Eurozone retail sales for May rising +0.2% m/m and +2.4% y/y. Grexit contagion candidate members like Spain saw year over year sale figures climb +3.4%, which indicate that consumer confidence is holding up despite the threat of Grexit occurring. The ECB will be very happy that the current stimulus program is providing a positive pickup in private consumption.

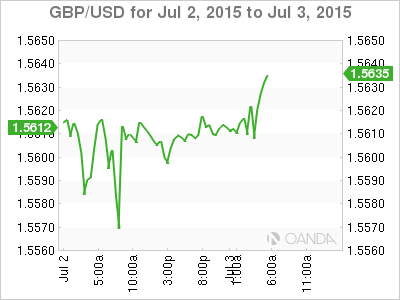

The U.K can also seem to rely on their service sector for support when other areas maybe having difficulties. Friday’s U.K services PMI data headline is a welcome boost for the Government. It rose from a five month low in May (56.5 – general election hangover) to 58.5 in June. Political uncertainty is always an issue and it seems that the U.K consumer was happy to spend once the May 7 general election outcome was know. Earlier this week, U.K consumer confidence number managed to touch a new 15-year high. Coupled with real incomes growing strongly and fluid credit conditions, fixed income traders will be questioning the Bank of England (BoE) first-rate hike timing. Currently, the safer bet is pricing in H1, 2016.

China Continues to See Red

It’s becoming more of an end of week routine, the Shanghai Composite signing off another Friday with another large loss. It’s closed out down -5+%. It seems that last weekend’s monetary easing measures is finding it difficult to gain market confidence. Investors should now be expecting Chinese authorities to tackle their financial shortcomings with more aggressive regulator and monetary support. The government needs to boost equity prices somehow, and they have to be more innovative sooner rather than later.

Earlier, China’s HSBC services figure hit a 5-month low (51.8), which signals a further loss of growth momentum from the world’s second largest economy. With data like this, the PBoC will need to provide further policy support during the latter half of this year to achieve its +7% growth target.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.