Greece situation sets off highest market volatility since 2008

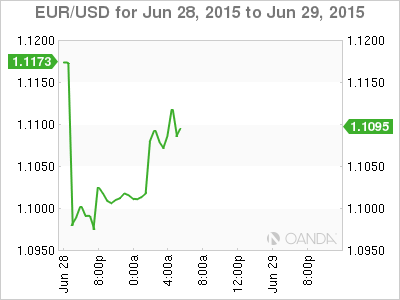

EUR filling in that plummeting gap

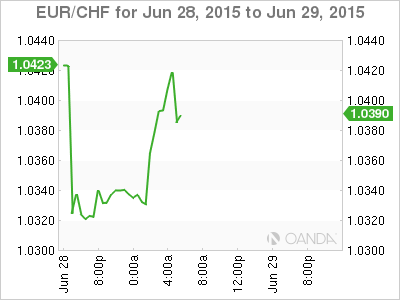

SNB vocal about today’s intervention

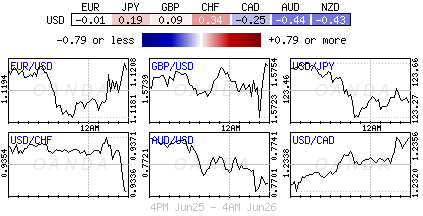

Market looking to Yen for help

Finding temporary safety to alleviate some of the Grexit pressure that is currently being imposed on capital markets is not that easy. Even the traditional safer option, like owning CHF, is becoming a bit of a problem. The weekends moves by the Greek government to call for a referendum on July 5 ensue there is no quick fix for their situation.

A referendum in favor of PM Tsipras position virtually guarantees Grexit, while support for Greece’s creditors offer should automatically force new federal elections and lead to further months of delays. At this point it would be difficult to get the Eurozone back to the negotiation table, they have lost their patience with Greece. Only a significant and sustainable market selloff will be able to pressure the eurozone to want to talk.

However, the probability that the Greek populace would vote to stay within the EU confines could provide the basis for more talks and negotiations. Nonetheless, until then, Greek capital controls will probably remain in place, while tomorrow Greece is now expected to default on its IMF loans.

Safe Haven Picks Difficult

There are no sure safe haven bets. In times of flight, investors historically gravitate towards the reliable – gold, CHF, JPY, USD, bonds – but that too is currently sending some mixed signals.

The EUR naturally took a beating on the Asian open, plummeting a big figure and change from Friday’s close to €1.0966, and has since managed to fill in the free fall gap mostly on eurozone rhetoric. Nevertheless, with the eurozone’s current predicament, the EUR bear will continue to feel confident that they have the upper hand.

It’s natural to see hedge funds wanting to lighten up on their Euro periphery bond exposure, especially when they had been expecting an eleventh hour deal. However, despite the heavy selloff in eurozone bonds this morning, current yields would suggest that the market remains somewhat content that Greece is not entirely on the verge of leaving the eurozone. Hotspot countries like Spain Italy and Portugal yield spreads to the German Bund have only managed to widen out to levels printed a week ago. Thus far, all the market seems to have done is price out some of last week’s initial optimism that a deal would be done. Periphery bond prices remain some ways off from pricing in a Grexit knock-on effect just yet.

Even U.S treasury yields are not portraying that sinking feeling. Yes, bonds have rallied along with other core eurozone bonds, but they are well off their intraday low yield print during the Asian session. U.S 10-years trade at +2.35%, falling from Friday’s close of +2.40% and rising from the overnight low of +2.30%. U.S yields have fair bit of domestic data to chew through before shutting down for the holiday-shortened week. Obviously Thursday’s non-farm payroll (NFP) report will be of particular interest to both money market and fixed income traders. They have yet to convincingly price in a September rate lift off, it’s still 50-50.

Swiss National Bank (SNB): The Outlier

The SNB’s underhanded policy moves it pulled last January (scrapping the €1.20 currency cap) certainly left a bad taste in investors’ mouths. Nevertheless, their currency is historically always in demand during “fight or flight” situations. However, it has been a prudent move to listen to SNB Jordan for directional clues, especially when the Swiss franc remains in such demand mostly from a safe-haven perspective.

The SNB has been intervening in the forex market since they abandoned the EUR/CHF peg five-months ago, but they would not confirm such intervention. Last week the SNB again reiterated that it could still intervene in the forex market, and/or apply more negative interest rates to release some of the external pressures on their currency. Verbal intervention seems to be the first tool of choice to weaken a currency. Still, today the SNB took an unusual step and said that they have intervened in the market.

Being proactive and vocal would suggest that Swiss policy makers want to discourage speculative “long” CHF positions to accumulate. The SNB acknowledges the “extreme uncertainty” that policy makers have to currently digest, but also admits that the SNB is not unprepared for a Greek default – they will be active. The SNB has already set a precedent of not sticking to the script. Therefor, owning CHF is not as easy or safe as it once was. Perhaps the SNB is required to go more negative on rates.

Because of the SNB actions, investors seem to be gravitating more towards JPY for primary surety reasons. Market consensus believes that the Bank of Japan (BoJ) is likely to be happy to see JPY (¥122.87) pullback from its recent lows. Politicians have been trying to talk yen back up for awhile and this move has been rather orderly.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.