Focus remains on Greece and ECB

EUR pares weekly gains on service PMI’s

UK services stumps sterling

Pound Bulls Look to Draghi for help

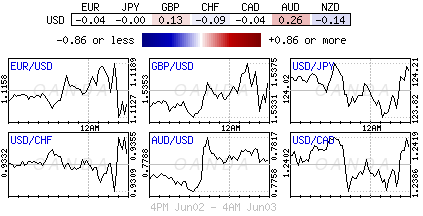

The current forex climate is a traders dream. The intraday price volatility knows few bounds. Currencies remain at the mercy of any headlines out of Greece where its creditors grapple with presenting a “non-ultimatum” set of guidelines, while Athens insist they have made “tough compromises” with only a few day left before the first IMF June payment (€300m) schedule is due. Then there is the Fed’s rate normalization timing – which is data dependent – and this Friday’s king of economic releases, non-farm payrolls, is expected to go a long way in helping fixed income traders nail down the possible timing of the Fed’s first rate hike along their yield curve. Then there is always the questionable sustainable growth worries and global inflation concerns to be keeping the speculative investor interested – stakeholders have been looking to this week’s non-manufacturing and service PMI touch points for clues.

Today, aside from Greek event risk, the single currency moves (€1.1110) will be dictated by the ECB and whatever Draghi may say at his press conference after the central banks formal rate announcement (they are expected to keep rates on hold). The majority of the market does not expect the recent surge in the EUR to be long lasting. Dealers still expect President Draghi to reiterate that the ECB intends to carry out its QE program in full until at least September of next year – dealers will be looking to the ECB’s inflation forecasts for support. Any dovish comments or further evidence of sustainable interest rate divergence will be expected to limit the EUR’s rebounds. Draghi committing to buying government debt for longer requires the central bank to print fresh cash – and much more of it will only weaken the EUR and favor the export driven region.

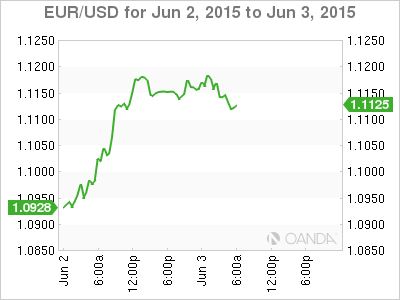

EUR Pares Gains Amid Weaker Peripheral PMI’s

The EUR is traded slightly lower this morning after a raft of final PMI Services data as well as continued speculation over Greece. Data this morning showed that the eurozone’s economy slowed less severely than first estimated last month (53.6 vs. 53.9) as activity amongst France’s services providers picked up. Of late, the routine has been that the eurozone’s second largest economy tended to be a slight drag on the final composite numbers. However, this time it was the peripheries, and in particular Italy. Despite recording its fourth month of consecutive growth, Italy’s service sector slowed in May to 52.5 from 53.1. Even with new orders slowing, Italian businesses remain sufficiently confident in hiring additional staff for the fourth consecutive month. Obviously the biggest concern to euro policy makers is inflation, and notwithstanding the service sector facing higher input costs, providers again cut their prices, although at the slowest pace in 18-months.

One of the ECB’s main goals is to lift the inflation rate back to its target of just under +2%. Obviously today’s data would suggest that the ECB’s QE program is showing early signs of success and reason enough why Draghi should be guiding investors to price in completing the program (September 2016). Nevertheless, today’s surveys do indicate that economic growth has not picked up in Q2 after Q1’s slight acceleration, and therefore should have no impact on inflation, except perhaps for the ECB to reassess its inflation forecast predictions.

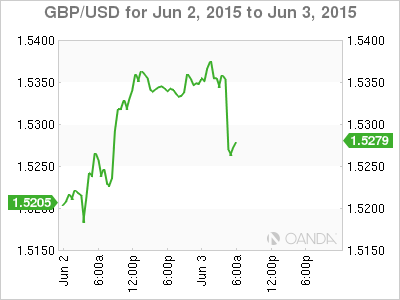

Big miss for UK PMI services weighs on Sterling

The last of the U.K’s PMI readings arrived this morning to show how robust PM Cameron’s consumer led recovery really is, and it massively disappointed the markets. So much so that sterling lost a near full cent (£1.5270) within minutes of the service PMI release. Forecasts were for a slight decline to 59.2 from 59.5 but trepidation with regard to last months general election appears to have weighed on consumer sentiment. The final print was a rather dismal 56.5. Economic prints like this will be an obvious blow for any ‘hawk’ advocating a pre-2016 Bank of England (BoE) rate hike. The pound has been a rate differential favorite on the EUR cross (€0.7290) and was expect to scoop towards the psychological €0.72 handle if U.K services beat forecasts. Now however, the markets bear witness to a near half penny cross rise to €0.7304 (its 100DMA and yesterday’s high). Sterling bulls will be relying on Draghi for some relief, well at least to help some of their positional pain costs.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.