Sweden’s Riksbank relies on QE, no rate cut

Dollar bulls feel the pressure

Investors look to FOMC statement for rate timing clues

BoJ and RBNZ no rate change expected

Today’s forex action will be dominated by Central Bank monetary policy announcements. The Fed, the RBNZ and the BoJ are expected to deliver a “no” change in interest rates, but as ever the accompanying statements will be the key for investors.

Earlier this morning, Sweden’s Riksbank decided to ease policy further. This time around the central bank is relying more on QE rather than a lower rate path – they prefer not to take the repo rate further into negative territory.

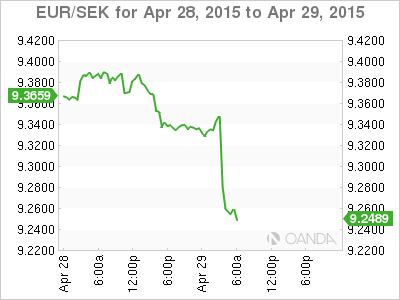

Swedish policy makers left its main policy rate unchanged at -0.25% (contrary to the consensus expectation of a cut), but more than doubled its government bond purchase programme, from a total size of SEK40b to SEK80-90b. They also lowered its forecast path for the repo rate to show rates unchanged until late 2016.

The option of moving between meetings has been kept open and after the surprise decision to ease policy in March the probability that the Riksbank could cut interest rates again in July should continue to seem very high to investors.

Currency Strength a No

The Swedish Krona (SEK) is again one of the key variables that have been a trigger for this morning’s easing (similar situation for the AUD and the RBA) – it’s deemed too strong for the Riksbank. They expect that expansionary monetary policy will contribute to the SEK “remaining at a weaker level for a longer period of time.” Therefor, expect traders to be anticipating further easing measures (rate cuts, QE, loans to companies and even forex intervention) to be linked to the SEK’s strength. Currently, EUR/SEK (€9.2570) is modestly stronger as the market had been biased towards a rate cut already.

Dollar Squeeze remains intact

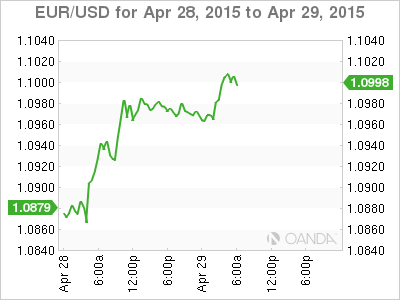

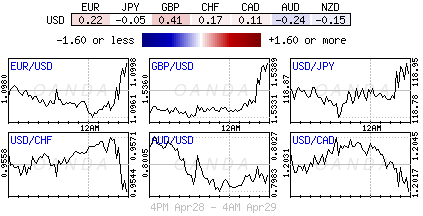

U.S dollar bears have found some momentum as U.S. data continues to disappoint ahead of this afternoon’s Fed policy statement. Yesterday, consumers reported feeling less upbeat this month (CB consumer confidence 95.2 vs. 102.6e), adding to the array of downbeat indicators, ranging from weak factory activity, business investing, industrial production and new-home sales. Collectively, softer U.S data has managed to take the wind out the dollars sails over the past few weeks and stall the USD’s strong rally earlier this year.

Investors will be keeping a close eye on today’s FOMC monetary policy statement for clues on how U.S policy makers view the economic recovery, especially after the plethora of weaker data lately. Consensus expects the Fed to adhere to a low rate policy well into the summer, as it waits for the U.S. economy to bounce back from its recent soft patch.

So far, both the forex and fixed income markets are at risk of a sharper adjustment of USD longs and bond longs as the lack of upside on these trades has seen a modest reversal in the last couple of trading sessions. Uncertainty has some investors diligently trying to protect their profits or limit their losses, by cutting these positions. This has contributed to the dollar underperforming and some U.S longer term yields to back up.

For many, USD longs and bond longs continue to be an attractive “core” position. But central bank event risk and market momentum is persuading many to consider trimming theses positions even further. This morning, the EUR has managed to penetrate the psychological €1.10 handle, which now allows the EUR bull investor to focus on the important €1.1062 target. However, for the EUR bull there is a lot of wood to chop through topside, as the majority of the market prefers to own new dollars on EUR rallies. For the fixed income enthusiast, U.S Treasurys are trading in tandem with the weakness in the eurozone bonds. Their core (bunds), semi-core and peripheral debt yields have risen by +5-6bps partially on the back of Greek negotiations hopes.

Australasia to deliver no surprises

For both the RBNZ and BoJ, the market does not expect anything new. The BoJ is unlikely to loosen its monetary policy despite some speculation to do so among some investors. Couple with the fact that the Fed is also unlikely to raise rates soon is the biggest factor preventing a stronger USD/JPY (¥119.32) and why the market has been confined to such a tight trading range for some time.

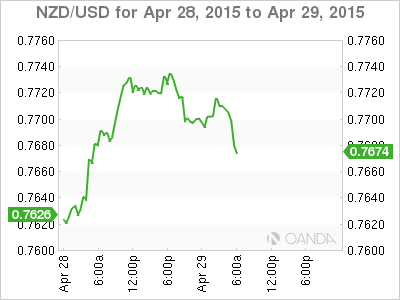

Some fixed income traders have priced in only a very “slim” chance of a rate cut by the RBNZ later this afternoon. The majority seems to favor the central bank to be more dovish, triggered by last week’s speech on inflation by the Reserve Bank Assistant Governor. Down under more economists are pricing in an eventual rate cut in New Zealand, but today’s meeting comes too soon (NZD$0.7676).

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.