China’s PBoC cut goes deeper than market expected

RRR ease frees up ¥1.3 trillion in cash

Greek April 24 deadline in sight

Major currency pairs prices remain contained for now

For this week’s global market economic events, investors will be watching Germany’s April ZEW and Ifo surveys rather closely to get a better handle on business expectations from Europe’s largest economy. The markets will also be monitoring the flash PMI’s for China, Japan, the Eurozone, France, Germany and the U.S for signs of growth. Tomorrow’s Q1 CPI from Australia will be surveyed for clues to the next RBA monetary policy move at the next meet slated in early May. While finally, all investor eyes will end off focusing on Friday’s April 24 deadline where the Eurogroup’s will be meeting on Greece.

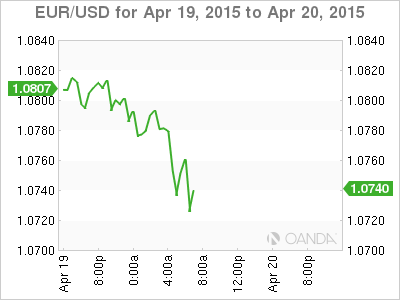

With the current impasse between Greece and its international creditors unlikely to be broken anytime soon, the EUR (€1.0740) is expected to remain under renewed downward pressure. It would be a surprise to the market if a deal for the release of the last tranche of bailout funds did happen before all Eurozone finance ministers sit down at the end of the week. However, if a deal were to happen the speculators bets are on May 11 as the more likely date.

China Reverts to Direct Stimulus

Despite it being a relatively quiet start to the week investors have had to digest some significant announcements from China over the weekend. Late on Friday, markets around the world sold off after reports quoted a China securities regulatory commission spokesperson “encouraging short selling” by institutional investors so as to crack down on high leveraged “umbrella trust” margin trading. The announcement did instigate the beginnings of a global equity selloff, and required the CSRC to clarify the statement on Saturday, indicating that it was not intended to punish equities or depress the market, but rather promote a “healthy” market function.

On top of all of that, the PBoC announced a -1% cut to the reserve ratio for all banks on its website on the weekend, the biggest cut in more than six-years (from +19.5% to 18.5% effective today). Policy makers also extended an extra -1% cut to rural financial institutions and a -2% cut to the rural policy bank. Collectively the cuts are estimated to release as much as CNY1-2 trillion of liquidity. The PBoC’s chief researcher explained the move as an intention by policy makers to keep liquidity stable, reaffirming “neutral stance” on monetary policy despite investor interpretations that China has now entered a more aggressive monetary easing cycle.

The surprise cut, and more specifically the depth of it, is considered significant from three different perspectives.

First, it highlights that Chinese monetary policy easing has yet to gain significant traction and the primary reason why policy makers have been required to be “bold” and aggressive. Nevertheless, the surprise move gives the PBoC the latitude to go deep again if required next time.

Second, the aggressive positioning by the PBoC would strongly suggest that China’s growth could very easily slip beyond the stated objective of “around” +7% while even acknowledging the growing risks of low inflation. Perhaps the world’s second largest economy is in more trouble than first thought?

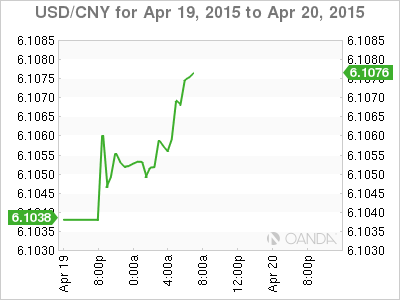

Finally, from a global perspective, it hardens the Chinese governments argument to keep CNY/CNH stable as opposed to seeing it depreciate further. The RRR cut in theory should be injecting more liquidity than an expected FX outflow (or declining FX reserves). This should also allow the PBoC flexibility to intervene in order to keep their currency stable.

The big winners in the reserve ratio cut will be banks. Analysts are estimating that this reserve ratio cut can support bank earning’s by as little as +2.7% and as much as +4.5%. The cuts will allow banks to free out the cash from deposit accounts and invest in higher yielding loans. The PBoC cut is also lowering the funding cost to banks. Banks can get capital more cheaply from deposits rather than getting short-term loans from the central bank.

The market seems to want to sit back and see how stateside investors wish to digest the weekend announcements out of China. The major currency pairs again have been well contained despite the RRR cut. The commodity and interest sensitive currencies like the AUD and CAD did find some initial support from the Chinese stimulus arrangements, however, the bid factor seems to have only be temporary as the currencies fall back inline ahead of the North American open. Obviously Greece will remain the big unknown factor for the week. Expect Grexit fears to continue to dominate rates, the EUR and equities, at least until the market gets clarity on Greece’s intentions.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.