EUR did not benefit from modest sales report

Weaker EURO aids eurozone export numbers

Loonie on the back foot ahead of BoC

Any Poloz surprise should crush the loonie bear

The market is not expecting any surprises in a few hours from either the ECB or the BoC. This ECB meet is being touted as the most “drama free” policy meeting in a number of years. President Draghi and his fellow cohorts are expected to hold policy steady, especially as Euro conditions seemed to have improved since the successful launch of QE in March.

In general, it’s a bit early to tell how well the QE program is doing, but consumer confidence has always been a fickle indicator. As usual, the post meeting press conference will draw most of the markets attention. With Euro yields at record lows and the ECB technically running short of product that qualify for purchase, there is a strong possibility that Draghi could announce a broadening of the range of bonds eligible for purchase under QE. He may also announce greater flexibility on the bond maturities that can be bought.

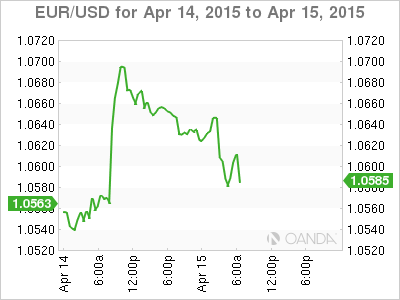

Single Unit Lacks Stamina

The 19-member single unit remains confined to its tight trading range, (€1.05-€1.08) again falling to take out yesterday’s psychological topside (€1.0695) with any momentum despite the modest U.S retail sales print (+0.9% vs. +1.1%). Disappointing U.S data has the fixed income market recalibrating again the timing of the Fed’s first-rate hike – September is being pegged at a possible 58% rate hike. Not helping the dollar was the IMF trimming its growth expectations for the U.S and upgrading its forecast for the eurozone.

Nevertheless, disappointing economic releases out of China seems to have given the leverage back to the dollar bulls, temporarily at least. In the overnight session, Chinese data continued it string of disappointing releases with Q1 GDP hitting its slowest quarterly growth rate in six-years (+7.0% v 7.0%e, y/y) – growth in industrial production, fixed-asset investment and retail sales all decelerated.

The worry about China is that most people think that the government will be able to do what it’s always done and manage the growth rate through more spending and further credit easing. For the time being, with inflation a relative non-issue will allow for much more government intervention. However, when the Chinese economy does get larger the impact of these policies eventually become weaker ane we start all over again.

Weaker EURO paying dividends

Other data out of Europe this morning showed that rising exports helped widen the eurozone’s trade surplus in February (+€20.3b vs. +€14.4b y/y). Exports were up +4% on the year, while imports were unchanged. This would suggest that the EUR weakness is paying off and should please the ECB. However, everyone needs a stronger eurozone, but there will come a time that the global growth imbalance will become more of an issue, especially with the U.S. Thankfully the global economy is still a long way from that scenario just yet.

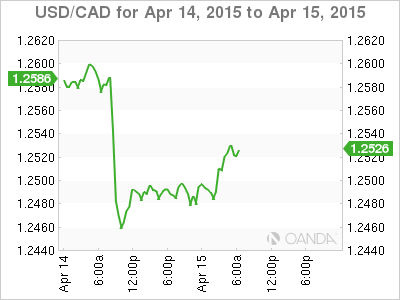

Bank of Canada – An unknown entity

Today’s Bank of Canada’s meet should be a straightforward process, but one cannot rely on that with Governor Poloz having already surprised the market this year with his one and done “insurance” cut early on. With the BoC there is always a small possibility of a rate cut, however, the oil market has stabilized over the last little while and the Canadian job numbers last week showed a vast improvement (+28.6k jobs and +6.8% unemployment rate) which both go a long way in giving the Governor some wriggle room. What the market should be most interested in is that the BoC will also publish its quarterly monetary policy report. The forecasts for the Canadian economy will be important to watch as they can give traders some idea of what kind of outlook the central bank is assuming and the possible scenarios for the benchmark rate.

The loonie is under pressure ($1.2533) ahead of today’s meet. It’s off its high print yesterday ($1.2445) now that the dollar has found a safe haven bid after the disappointing Chinese numbers overnight. A ‘no’ change decision is the expected consensus, however, a surprise rate cut would hit CAD hard, as per the shock cut on January 21. Any negative surprises and investors can expect the first line of resistance to be quickly tested topside ($1.2667).

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.