Street waits for Yellen this afternoon

Middle-East Tensions subside

Forex liquidity remains a premium

Market trying to avoid lopsided trades over Q1 end

U.S dollar buyers are back with a vengeance as the street waits to close out the week once U.S Gross Domestic Data has been released this morning, and perhaps more importantly after the Fed Chair’s speech this afternoon. Ms. Yellen is due to speak about monetary policy at the Federal Reserve Bank Conference titled “The New Normal for Monetary Policy,” in San Francisco at 15:45 EST. When audience questions are expected, on rare occasions the market may get ‘unexpected’ answer.

For the time being, the dollar bull seems to be encouraged by number of factors. First, the slow grind higher in U.S front yields (U.S 1-year +7bps to +0.25%), partly due to a continued recovery in crude prices (WTI $50.25) and second, some hawkish comments from Atlanta Fed Lockhart. Even geopolitical risks are giving a helping hand to the dollar.

Tensions in the Middle East, stemming from Saudi Arabia and its allies launch of a military campaign in neighboring Yemen, seems to be easing somewhat this morning. This should subtract some of the risk premium that has been priced in over the last two trading sessions. A large percentage of the dollars strength should be attributed to the markets recalibration of geopolitical risks, allowing some risk appetite to gain traction.

Liquidity a premium

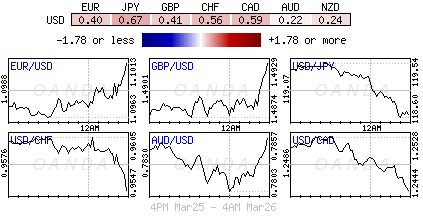

With month-end, quarter-end and Japanese financial year-end fast approaching, and the start of earnings season atop us, investors will be trying to avoid taking any lopsided positions; hence the reason for some of the dramatic intraday forex market moves.

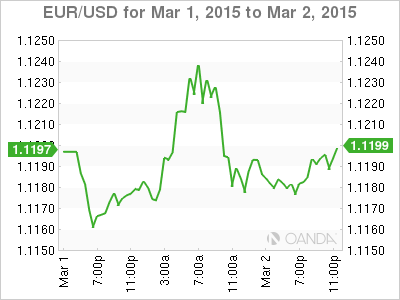

These FX moves highlights the lack of market depth concerns expressed by both dealers and investors. Last week, the EUR managed to swing +8% in a matter of hours after the FOMC statement, and earlier this week after U.S CPI, the dollar suffered a +1% whiplash move. Even the BoE is worried about market liquidity, not specifically for forex, but capital markets. With the Fed trying to wean the market off central bank dependency, pushing investors towards data dependency, coupled with the lack of product depth to grease the ECB’s QE wheels, will only support market volatility going forward.

Even the interbank dealers have their own problems. Few are unwilling, or cannot afford, to run risk and very often currency prices become a premium. For now, this is the new “norm.” Heightened volatility certainly provides more market opportunities, but that too also that requires more patience and a very disciplined risk management approach.

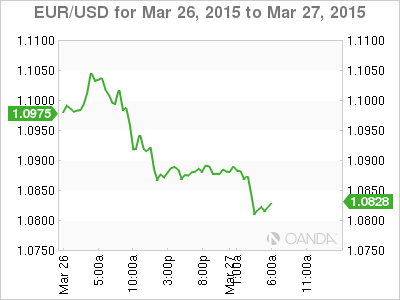

EUR Rally Comes Unstuck

The only thing that the ‘tech’ market is assured of at this moment is that the EUR does not like heights. Price action above €1.1000 was unsustainable, again. The single currency’s weakness (€1.0818) from yesterday’s bull trap high at €1.1052 is currently regarded as part of an irregular flat correction. This is expected to remain the case while EUR support at €1.0775 holds.

So far this morning the market has attempted to bottom fish for the weak EUR ‘long’ stop-losses located atop and just below the psychological €1.0800 handle. A sustained market break below the support trend line (€1.0775) would alter market scenario rather quickly, exposing €1.0697 and last Sunday nights low €1.0613.

On the other hand, the EUR bull needs to recapture territory above €1.0935 to feel more comfortable. Through there €1.0970 and the psychological €1.1000 should be exposed once again.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.