Global bourses bounce on hawkish Fed

EUR bears chasing the unit lower

IMM Euro shorts below peak levels

German manufacturing orders disappoint

Risk appetite seems to have found some much needed love after yesterday’s December FOMC minutes indicated that Fed officials were willing to be “patient” on interest rates. Although the Fed signaled that rates are likely to climb this year, the minutes showed officials were worried about weak growth overseas and endorsed efforts by the ECB to stimulate their economy.

This market optimism has managed to spill over to the various regions with equity markets opening up sharply higher amid gains in late US trading yesterday. Even in Europe, Greek markets have the green light temporarily amidst lower bond yields and speculated debt renegotiation talks.

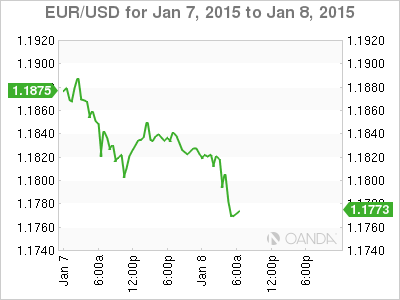

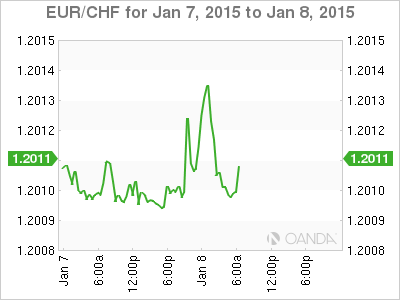

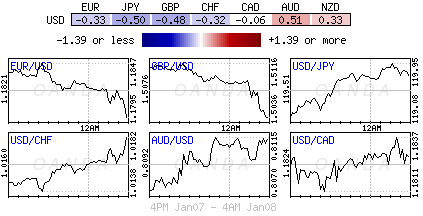

For the EUR bull, the lesson seems to be do not attempt to catch a falling knife. So far this year, picking an outright bottom for the 19-member single currency has been a costly experience. Every other day in this New Year new record lows have handily been made and to try and find a EUR buyer is proving difficult. Sometimes it looks like the Swiss National Bank is the only true buyer of the EUR. They are committed to making sure that the psychological EUR/CHF €1.2000 ceiling/floor is not going to be breached. The EUR/USD is now testing below the €1.18 handle after recent EU inflation data appears to have intensified market expectations that Draghi and his fellow cohorts at the ECB would announce further policy action in the form of QE or sovereign bond buying at the January 22 meeting.

Euro shorts pain free

For the EUR the lack of material bounce is intensifying bearish sentiment. Year-to-date, short EUR positions have been a near pain free experience, especially when the market broke the psychological €1.2000 handle on this weeks open. One gets the feeling that unfilled offers have been chasing the pack, forced lower and dragging with it resistance levels, while disregarding various support levels. The EUR’s significant break lower on Asian’s open this week would indicate that speculators and weaker “bull” positions are now rushing to sell almost any downside breaks.

Looking at IMM future contract positions earlier this month, the market was not significantly short the single unit. Current future EUR shorts are still -15% below last year’s peak and -30% below the 2012 record. The obvious risks from Greece exiting the eurozone, and the ECB meet, have been able to keep rebounds relatively weak. The “lack” of short EUR positions would suggest that investors couldn’t afford to wait on a corrective future EUR bounce to speculatively sell. The manic selling has even portfolio managers needing to sell the EUR to adjust reserves and account for the unit’s losses. The current market pattern indicates that more sharp movement should be expected around big handle and half numbers (€1.1750, €1.1700, €1.1650).

Data Dents EUR’s prospects

After just seven days into the New Year crude plummeting prices, closely followed by Central Bank rate divergence, will most likely be the top stories for this calendar year. Most of the forex price moves have been instigated by momentum rather than fundamentals. Investors and the market have not wholly factored in the knock on effect, positive and negative, from plummeting crude prices just yet, despite it beginning to seep into data headlines.

Eurozone retail sales rallied for a second consecutive month in November (+0.6%, m/m) an indication that falling crude prices are beginning to have a net positive influence on the vulnerable Euro region. Lower energy prices allows for higher discretionary income to be spent on goods and services. The November monthly pick up was driven by a +1.4% rise in sales of goods and services rather than on perishables. Net effect, it can only support economic growth. Collectively, the two good months should be able to ease some of the deflation fears that are running rampant throughout the market after yesterday’s negative Eurozone’s flash CPI headline for December.

The main problem for policy makers is that the Euro consumer still remains the main supporter to very weak growth in the region. The backbone for Europe, Germany, manufacturing orders fell unexpectedly in November (-2.4%), an about turn to the previous months robust growth headline print. Other Euro data found that Euro manufactures became less optimistic about their prospects as 2014 came to a close. Their fears have been driven by weaker new-orders and stocks beginning to pile up. Collectively, the data strengthens the case for the ECB to launch further stimulus measures. In what shape or form no one knows, but the market is betting heavily on January 22 for QE. It’s now up to Draghi to stand and deliver.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.