Investors around the globe continue to look for signs about the economic health of major economies. Preliminary factory and service output started being reported by Markit and HSBC yesterday night.

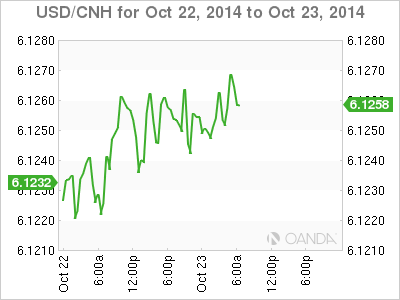

The flash Purchasing Managers Index (PMI) in China beat expectations yesterday as it rose above its September reading 50.2 to 50.4. The preliminary data points to the resilience of the world’s second largest economy as labor market and export demand remain strong despite other economic pressures.

There is a lot to be optimistic about China with output, new local and export orders rising. The Flash PMI is based on 85% to 90% or respondents so there is a chance it might change for final number in November 3, but the preliminary figures give the market a solid data point to use for setting expectations.

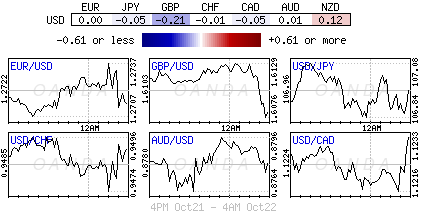

European PMIs continue to be mixed. German manufacturing figures beat expectations with a 51.8 factory output preliminary result after a disappointing 49.9 reading last month. The fact that Germany’s flash PMI is above 50 is a sign that the contraction was transitory. In contrast French flash PMI came in lower this month than last. October figures are 47.3 coming in below expectations that the factory output from France would be close to that reported last month of 48.8. It seems that the reduction of the speed of contraction in French manufacturing was also transitory.

The European flash PMI had a net positive gain thanks to the German growth. The PMI rose to 50.7 in October beating expectations that the eurozone would show contraction. The expectations were heavily influenced by the surprise decline in German manufacturing in September.

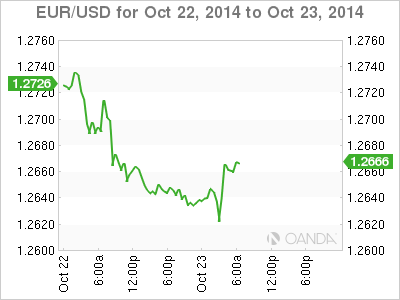

The results shine a positive light on Europe’s chances of avoiding a recession although a lot of work needs to be done on the political arena to unlock the quagmire that has prevented the European Central Bank from deploying a more direct quantitative stimulus package. The situation is so delicate than even the rumours of corporate bond buying had a deep and lasting effect on the EUR/USD even though the ECB later denied that there was a clear plan on such purchases.

Spanish unemployment was released today and it also beat expectations with a reduction to 23.7%, this is the lowest since 2011. There have been reforms implemented to coax employers to speed up their hiring, but while mildly successful Spain remains the second-highest unemployment country in Europe after Greece.

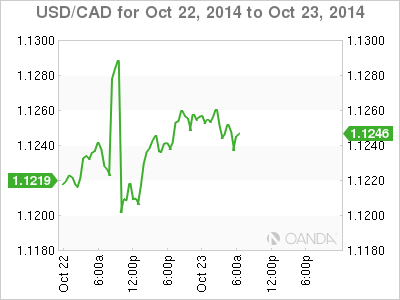

A gunman opened fired inside the parliament building in Ottawa in what is believed to be a terrorist attack that claimed the lives of a soldier guarding a war memorial and the intruder who was shot down. This is the second terror related attack in the week for Canada who until now had so far escaped being the target of this type of attacks. Financial markets reacted downward as a flight to safety was triggered awaiting word from the Canadian government and further developments.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.