EUR/USD has lost ground on Tuesday, giving up most of the gains earned a day earlier. In the European session, the pair is trading in the mid-1.26 range. The euro weakened on a dismal German data, as ZEW Economic Sentiment dropped below the zero level. Eurozone indicators did not impress, as ZEW Economic Sentiment and Eurozone Industrial Production softened. There are no major releases out of the US on Tuesday.

German ZEW Economic Sentiment, a key indicator, took a sharp drop in the previous release, falling to -3.6 points. This reading was the first contraction since October 2012, and points to pessimism among investors and analysts. There was no relief from Eurozone data, as ZEW Economic Sentiment dropped to just 4.1 points, compared to 14.2 a month earlier. Industrial Production came in at -1.8%, its third decline in four readings. The Eurozone continues to struggle, and we’re likely to see the downward trend continue, which bodes badly for the struggling euro.

US Unemployment Claims were unchanged last week, coming in at 287 thousand. This beat the estimate of 291 thousand. The indicator has now exceeded the forecast for four straight readings. Earlier in the week, JOLTS Job Openings climbed to 4.84 million, up from 4.67 million a month earlier. These numbers followed an excellent Nonfarm Payrolls report, as the US labor market continues to improve. With QE slated to end later this month, the focus will shift to the timetable for an interest rake hike. Stronger employment numbers are likely to put pressure on the Fed to make an interest rate move sooner rather than later in 2015, and increased speculation about a rate move could push the dollar even higher.

EUR/USD for Tuesday, October 14, 2014

EUR/USD October 14 at 10:30 GMT

EUR/USD 1.2674 H: 1.2716 L: 1.2650

EUR/USD Technical

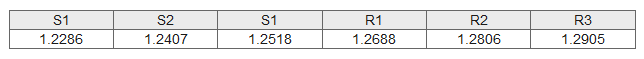

- EUR/USD posted losses in the Asian session. The pair continued to lose ground in the European session, breaking below support at 1.2688.

- 1.2518 is a strong support line.

- 1.2688 has reverted back to a resistance role and is a weak line. 1.2806 is stronger.

- Current range: 1.2518 to 1.2688

Further levels in both directions:

- Below: 1.2518, 1.2407, 1.2286 and 1.2144

- Above: 1.2688, 1.2806, 1.2905, 1.2984 and 1.3104

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.