The forex markets requires a diverging interest rate policy amongst G7 economies for 'sustainable' volatility. In 2014, geopolitical risk has been regionally contained and risk-on or -off trading strategies have been orderly executed, no matter if it has been Russia/Ukraine, Gaza, Syria or Iraq influenced. Various individuals will argue that the Fed's zero-interest rate policy (ZIRP) model (followed by Japan and most likely soon to be Europe) is creating a "moral hazard" environment, encouraging the formation of asset bubbles that will eventually burst and lead to a deeper economic mess. These symptoms are reason enough to want to fully comprehend CBanks rate thinking.

This week, investors will hopefully gain further insight to understanding the current mindset of policy makers from various inflation reports, CBank minutes and from Ms. Yellen's attendance at Jackson Hole Economic Symposium. To date, the BoE has been hotly tipped to be the first of the developed CBanks to hike rates. Up until last week the market had been pricing in a U.K November hike. However, the BoE's Governor Carney has been able to thrown cold water on that idea, citing excess capacity in the labor and wage department. Tomorrows UK MPC minutes should be able to shed some light whether any BoE 'hawks' have split from the consensus and voted for monetary tightening. Nevertheless, it's todays surprising UK inflation data that is pressurizing the Pound's current advances.

Carney can afford to wait

It was not a surprise; UK inflation was expected to fall in July, but not by this much. It cooled more than expected (-0.3% vs. a -0.2% drop) and has now eased pressure on the BoE for an early rise in interest rates. The annual rate of inflation fell to +1.6% in July from +1.9% a month earlier, and takes the annual rate of inflation well below Governor Carney's +2% target. Subdued inflation has been a global CBank phenomenon, and despite strong UK economic growth, the BoE will not feel pressured to act. Dealers and investors should now feel more comfortable pricing in a UK hike for Q1, finally eliminating anything happening this year.

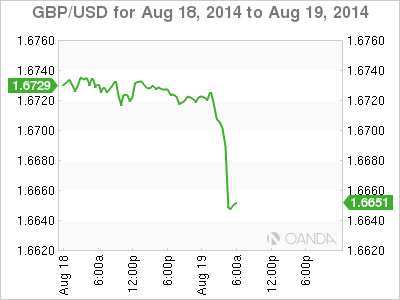

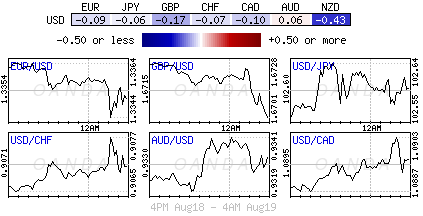

GBP/USD (£1.6650) has managed to fall to a fresh four-month low, basically giving back all of the Carney hawkish comments over last weekend. Sterling's fall from grace this morning is also managing to support the EUR indirectly on the cross (€0.8023). Technically, this morning's sharp drop highlights the underlying bearish structure of the market, through £1.6640 with conviction gives way to another big 'fig' below. A plethora of resistance levels now come into play topside - the Sterling bear should be expecting more GBP offers to appear around the psychological £1.6700 handle.

The market will now shift its focus to tomorrows MPC minutes for the BoE's August 6th meeting. Will any of the nine members have jumped ship and called for a rate hike? Before last week's Quarterly Inflation Report (QIR) the market was probably looking for one dissenting member. Ever since the dovish report - highlighting the lack of wage growth and slashing of 2014 growth forecasts - has probably changed investors mindset. The QIR has lessened the chance of a split, and the consensus is for a 9-0 reading.

EUR bear seeks support

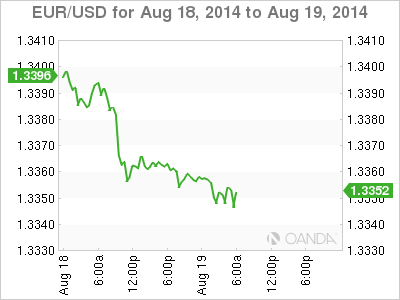

Euro equity markets have so far extended the gains seen in yesterday's Wall Street session (again led by the DAX, which is highly sensitive to Ukraine affairs) amid lack of significant news flow out of Russia/Ukraine. Despite the situation remaining highly delicate, easing of tension is allowing for some risk trading. Nevertheless, the single unit's opening maneuver this morning is a fresh test of its current €1.3330-40 range.

There has been no new 'real' news to drive the EUR lower, nor a material shift in risk appetite or a change in the Bund/Treasury spreads. All of these reasons should clearly support the EUR bear's position. If the EUR/USD is unable to rally on risk then the 'long' positions have a problem. Currently, the outright EUR positions are being indirectly supported by weaker cross currencies - EUR/GBP (€0.8019). EUR stop losses are beginning to pile south of the recent 2014 low (€1.3333). The EUR's inability to climb does make these positions more vulnerable. The technicals require a sub €1.3333 close to support the EUR bears current endeavor, and opens up a new handle below. Nevertheless, with option barriers dotted about, there will be a reluctance from investors to trade ahead of Jackson Hole or today's US inflation report with conviction.

Aussie 'carry' trade has support

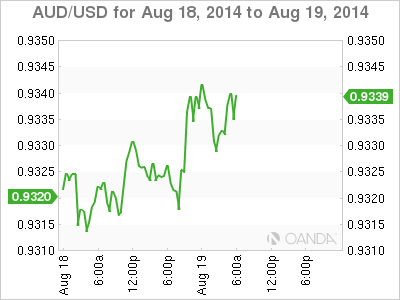

Investor involved in the AUD 'carry' trade, particular those financed in EUR's, found some support from the RBA last night. Governor Stevens indicated no change to their view that interest rates were likely to remain 'on hold' for some time. The RBA minutes indicated that despite the uncertainty in economic outlook, "steady rates remained the most prudent course." Dealers have been pricing in a +50% chance that the next move in interest rates will be down in H1, 2015. Similar to other CBanker's, "greater labor market slack and the reassessment to balance of risks to the wage/inflation outlook" will underpin the RBA's rate policy normalization policy. Higher unemployment and weak commodity prices may indicate that the Aussie economy has been contracting, hence the potential need for a pricing ease.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

GBP/USD hovers around 1.2500 on the stronger US Dollar, focus on BoE rate decision

The GBP/USD pair trades on a softer note around 1.2500 on Wednesday during the Asian session. The USD Index recovers modestly to 105.40, which drags the major pair lower. Investors focus on the upcoming Bank of England's monetary policy meeting.

Gold price recovers its recent losses, despite a firmer US Dollar

Gold price attracts some buyers during the Asian trading hours on Wednesday. Safe-haven demand, fueled by geopolitical tensions and uncertainty, as well as ongoing central bank purchases, might contribute to a rally in gold.

Ethereum resume sideways move as Grayscale files to withdraw Ethereum futures ETF application with the SEC

Ethereum is hinting at a resumption of a sideways movement on Tuesday after seeing inflows for the first time in seven weeks. Grayscale withdrew its application for an Ethereum futures ETF, and the SEC’s Chair Gary Gensler has also called most crypto assets securities.

No obvious macro catalysts to steer the bus

The US data calendar remains relatively light, with initial jobless claims and the University of Michigan survey being the key focus. However, these releases may not provide a significant catalyst for the next directional move in the US Dollar.