Modest risk is being applied across the various asset classes, with investors believing that major political concerns that drove stocks lower, bond prices and the dollar higher last week have somewhat abated. The market continues to distinguish between the humanitarian crises in Gaza and Iraq, which are not true market drivers, and the Ukraine conflict, which has far more potential to influence asset prices. The news that Russia was reported to have ended its military exercises on the Ukraine border is risk positive, as too is the Gaza ceasefire and pro-Russian rebels asking Ukraine for its own ceasefire.

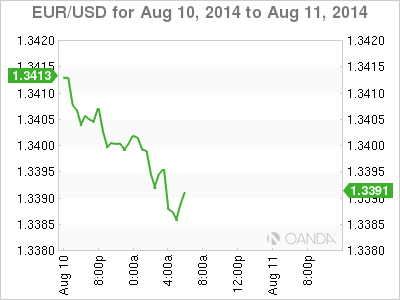

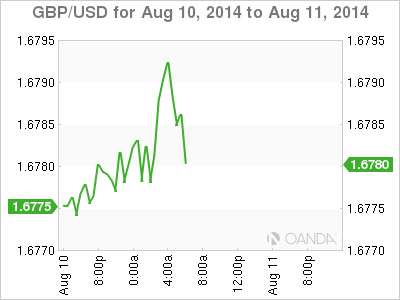

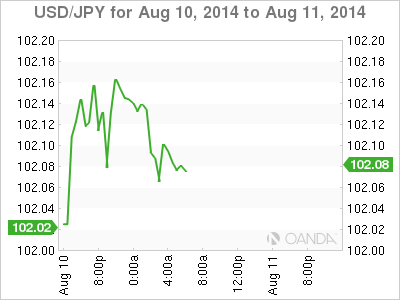

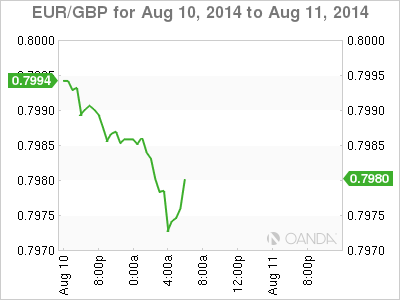

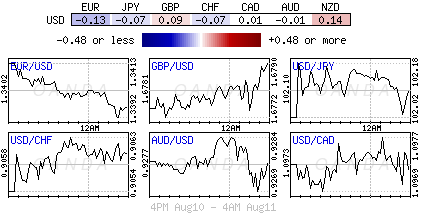

Forex thus far has seen little volatility in the overnight session, preferring to keep to its relatively tight ranges. The 18-member single unit trades just below the psychological €1.3400 handle, while USD/JPY continues to stray north of ¥102 level, and this despite the ECB and BoJ both expressing interest in having a higher dollar last week during their respective press conferences. Capital markets continue to look for interest rate clues and the CBanker in pole position to indicate a possible change to the monetary policy is Governor Carney at the BoE. The pound is floundering just below £1.6800 level in quiet trade. Despite Central Banks rate announcements done for a while, the market will get to hear from Carney midweek. On Wednesday, the BoE will publish its forecasts for growth and inflation and investors will be looking for clues on the timing for the U.K.'s first post-crisis rate hike. If the BoE happens to lower its expectation of slack in the UK economy it could be supportive of Sterling.

US Retail Sales to dominate

Despite this week having a variety of key releases, two stand out in the US. The manufacturing sector has been strong recently with their latest surveys. The Fed releases its industrial production (IP) report on Friday - confirming or not the strength seen in surveys. For the Fed their go to support has been the consumer, whose sector is showing moderate renewed strength - especially seen in the improvement in weekly jobless claims. Investors get to react to July's retail sales report this Wednesday and on Friday's consumer sentiment report. Even though some 'risk' is being applied, both the bund and treasury yields remain not far from last Friday's lows. The Ukrainian situation is likely to remain "both fluid and tense," and reason enough for many to want to hold some risk aversion strategies.

CFTC Risk Aversion Report

The latest CFTC report (up to August 5th) reflected the large jump in risk aversion trades. Dealers have been piling into long USD positions and were at +66% of their three-year maximum. Of late, investors have been turning against both the JPY and the EUR. The market ended last week applying a small squeeze, mostly on the back of some individuals believing that those trades or positions may have gone a bit too far. The EUR has managed to rally from its nine-month low (€1.3333), but continues to lack conviction. Yen on the other hand, has see USD/JPY fall from its four-month high print in July (¥103.15), but continues to have Governor Kuroda's backing to underperform for Japan's economic survival. Also of notable help, a Nikkei report noted Japan's Government Pension Investment Fund (GPIF) has temporarily scrapped its cap on the proportion of domestic shareholdings from August 5th until September to allow an increase in purchases of domestic stock.

Markets will continue to keep a sharp eye on Euro spreads (bunds/periphery) for direction. With the peripheries expected to see a supply free week, with no slated issues coming, and Germany to come to the market on Wednesday to sell 10-years should have dealers tightening that spread to make room to take down supply. This should be an ideal chance for spread tightening positions to gain some lost ground. Geopolitical concerns have managed to push German 10's to record low yields (+1.02%), while even shorter product has been trading negatively. The market expects Spanish paper to continue to outperform Italian on better domestic growth scenario. Spain's Q2 GDP print came in at a better than expected +0.6% headline while Italy has slipped back into a technical recession.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.