Capital Markets require rate divergence for sustainable volatility, which in turn drives greater investor interest, more volatility and so on. The market just wants price movement. To date, Central Banks and option traders have been successful to handcuff, in particular the forex asset class, to tight, contained and boring currency ranges for many months. Even geopolitical risk, when considered on a grand scale, has had a minimal impact on the markets twin problems of “volatility and volume.” Intraday volatility has appeared – last week’s tragic events over the Ukraine combined with the Gaza offence saw the VIX (everyone’s fear gauge) jump +32% intraday to +14.5. This was the twenty-second highest jump ever recorded. However, the fall out of geopolitical and historical events has been short lived so far in 2014.

Are investors putting too much faith in Central Banks to rein in market tension? Market direction depends on G7 monetary policy changing. To understand and appreciate the G7 curve will yield greater long-term awards. All the forex market requires is for a Central Bank to tighten and there has been talk.

Surprise, no MPC dissent

The UK economy has been on a roll, strong growth numbers, more jobs and a housing boom (potential bubble). It’s an economy envied by many other developed nations. The BoE is being highly touted to be the first of the major CB to possibly hike rates, even before the year is out (FI have a hike priced in for November). The markets scours for clues for that possibility and if and when confirmed, dealers will know what positions to protect or discard.

In the end and a surprise to a few, today’s MPC minutes for last months BoE meeting were decisive. Member’s voted unanimously to leave the benchmark rate at a record low of +0.5% in July. The minutes made it clear that there is as yet no preferred timing for a first raise in the rate. As per usual, there were arguments for and against, but no sense of a partial consensus. Indeed, the minutes suggest that there is many areas of uncertainty, including the amount of spare capacity (a Central Bank’s catchphrase) in the economy given that unemployment rates are falling and yet real wages have yet to rise.

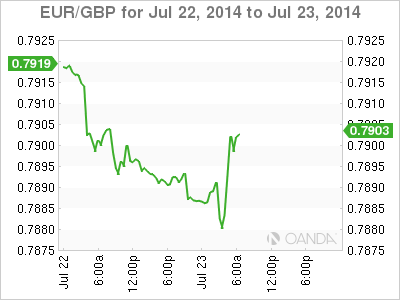

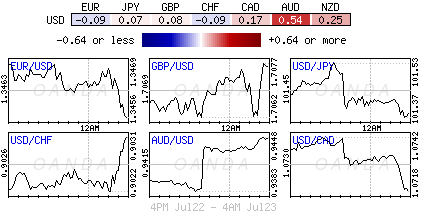

Once the 9-0 votes was confirmed GBP was sold, not aggressively (£1.7040), however, the 21-DMA (£1.7106) should now weigh more heavily on the pound short term. GBP longs will now become more reliant on an unlikely EUR/USD rise for support. Intraday speculators have interest to sell EUR/GBP rallies above €0.8010-20 in the short-term. The reality is that today’s MPC minutes should be viewed as awash for the market with relatively little impact. Incoming data is more important, and it’s prudent to look to tomorrows UK retail sales and Friday’s GDP numbers for directional GBP inspiration?

Stevens ‘jawboning’ to continue?

The Antipodean currency pairs certainly have a vocal Central Bank backing. If it not the RBA’s Stevens attempting to ‘jawbone’ the AUD down, then it’s Governor Wheeler at the RBNZ highlighting how overvalued the Kiwi is in relative terms. Both Central Banks are supposedly on the cusp of actually doing something to their monetary policy. Both the NZD and AUD has been the recipient of much love from a ‘carry’ trade perspective for a long time and it’s no wonder that policy makers gripe about the high value of their own currencies from a competitive sense. In times of low volatility, investors have been happy to reach for yield, which both Central Banks amply supply.

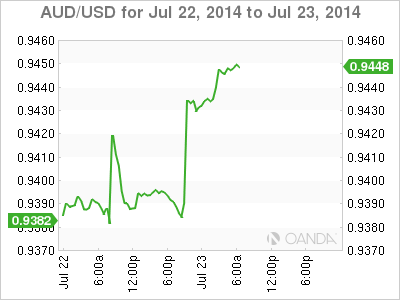

There was a slimmer of hope that the RBA could be in a position to possibly ease rates soon, however, overnight data should dispel any such ideas. Rising Aussie Q2 price pressures should be capable of thwarting any RBA easing. Australia’s core consumer prices gained more than economists forecast last quarter, affirming policy makers’ decision to adopt a neutral interest-rate stance. The AUD/USD has rallied, breaching the psychological $0.94c level to trade $0.9445 as investors pare bets on a further cut to the record-low 2.5% cash rate.

Accelerating inflation poses a dilemma for the RBA – certainly makes ‘jawboning’ the AUD lower non-effective and higher rates makes it more difficult to face a slowdown in growth, especially when mining investments wane, and a government is actually cutting spending.

Kiwi bulls to tread softly

The RBNZ faces a difficult decision this evening at their monetary policy meet. It’s the Central Bank that pioneered “forward guidance” and the markets have priced in an 85% chance that the Governor will endorse a fourth straight +25bp hike to +3.50%. To do anything else the RBNZ will have “ambushed the market” and lose all credibility. It’s all about fine-tuning and keeping the correct balance when making any changes – they should be subtle and non-hurting to growth. Governor Wheeler needs to convince the markets that RBNZ policies are calibrated and in sync with their domestic economy (hit to sentiment from lower dairy prices, manufacturing job losses etc.). Wheeler needs to plainly sign post their intent for the remainder of this year. The risk is that the RBNZ fails to signal a pause for the rest of 2014, but “stays fixated on balancing potential growth vs. potential output.” The outcome will determine if the market gets a new high (NZD$0.8689). If the pause comes sooner and more extended Kiwi bulls could be in trouble!

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD trades on a stronger note 1.2530, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The United States Employment report will be released by the Bureau of Labor Statistics at 12:30 GMT. The US Dollar looks to employment data after the Fed signaled its intention to hold rates higher for longer on Wednesday.