At the best of times, investors have difficulties handling risk and the current trading environment is no different - it seems that the idea of trading risk is not easily transferable amongst the asset classes. The slight rise in risk appetite in equities is failing to make its way directly into the foreign exchange market. U.S equities closed yesterday well off their lows after President Obama and company refrained, thus far, from further sanctions against Russia. Nevertheless, this morning's EU foreign minister meet in Brussels could require investor's, once again to change their trading strategies if an outcome of stiff sanction penalty's are imposed. The most market-friendly outcome from today's EU ministers’ meet is that they talk tough, but don’t intensify sanctions against Putin's Russia.

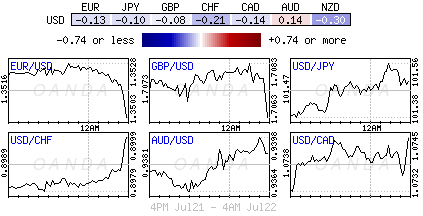

The 'mighty' dollar has gained since last week on geo-political risk and that trend is likely to continue for a while. Despite geo-political fallouts not lasting long this year, this is still a very tricky period for asset markets. The current investor positioning needs still reflect a desire to buy riskier assets, but mainly focused on EM, stocks and Asia, rather than peripheral Europe. This alone should have the 18-member single unit to continue to grind lower, pushed even further by tough talk against Russia.

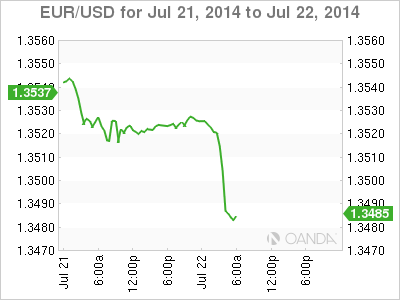

Euro year Low threathened

Already this morning, the single unit has managed to penetrate through the psychological €1.3500 handle with its sights locked on January's lows below €1.3477. The market should be expecting the EUR-crosses to be leading the way rather than the EUR outright. On a cross-weighted basis the EUR now trades below when the ECB cut rates back last November. The risk reward now favors the EUR funded carry trade rather than being outright short the single unit. Through this year's January low, the EUR should be capable of gathering further downside momentum, dragged by the crosses and pushed lower by the dollar on the back of Fed tapering to end in Q4. The techies like a EUR with a €1.32 handle for starters. Perhaps the EUR will get a helping hand from the US market today. Its focus will be on US CPI (+0.2% vs. +0.3%), where a high print would be more damaging to asset markets than a low print would be positive.

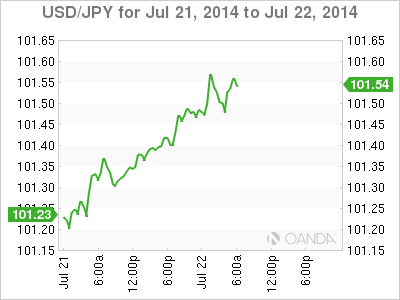

Japanese cut growth expectations

Aside from the EUR's immediate plight, the dollar continues to retain a decent bid tone against the major pairs, where a few are not even helping their own cause. The JPY has aided the dollar (¥101.53) by its own slip up directly after the Japanese government cut both its inflation and growth estimates (1.2% from 1.4%) for 2014. Fin Min Aso has conveniently put the blame on lagging exports amid soft demand from emerging economies. Even the Prime Minister's office has come under some scrutiny - a Sankei survey revealed the disapproval rating for PM Abe's cabinet climbing +6pts to a record high above +40%. Aside from Germany's Merkel, all major leaders are experiencing the same populous disapproval. In Japan, the thorn in PM Abe's side has been the April sales tax, and an outcome not fully comprehended or filtered through the Japanese economy just yet. Economic Minister Amari has managed to reiterate that the Japanese government will not make a decision on another sales tax hike until this December - another way for the government to bide some time.

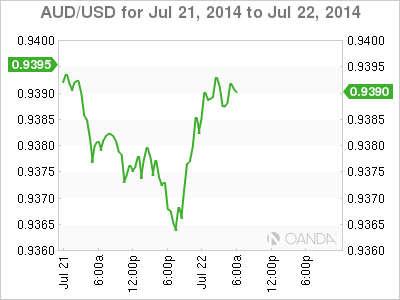

RBA's Stevens hints at ease

Japan cannot have all the fun. The return of Japan from a long weekend has led to a positive session from the Asian equity space. However, geopolitical tensions have never been far away and any underlying market weakness has led to the facilitation of dealers to add to their fixed income curve flatteners - whether it's Japan, Europe or US, the market continues to pick away at a back up plan. The 2's/10's German curve is now atop of levels not seen since 2008. No trade seems to have "full gusto" support, but the fact that investors and dealers are picking away at 'flatteners' highlights some of the precarious current positions that have been taken on.

Ignoring most of the signs of late has been the antipodean currencies. They seem to prefer to follow closely their respective Central Bank's beat. The AUD (Aud$0.9387) dollar has managed to stay within striking distance of the psychological $0.94 handle and now more so, especially after RBA Governor Stevens neglected to mention or to attempt to 'jawbone' the exchange rate overnight as had been widely speculated by the market. Instead, he left open the possibility that the next move in interest rates would be down in a following question and answer period. Dealers will look to Australia's quarterly CPI data this evening for further currency direction inspiration rather than CB insinuations.

Governor Carney at the BoE is under pressure from the UK media. From his stint at the BoC, the market understands that he is certainly a governor onto his own, and will not be persuaded from outside sources. Tomorrow the market will find out if any of the members of the MPC of the BoE has finally pulled the trigger and voted to raise rates from a five-year record low (+0.5%). An itching trigger finger would be the markets first major indication of possible rate divergence amongst the 'biggies.' Rate divergence equates to volatility, up or down, market does not care as long as it moves. The question will be is the UK economy strong enough to withstand a hike that could help deflate a rampant housing bubble?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.