The reality is that geopolitical events are 'front and center,' firmly catching the attention of investors and all asset classes. To date, favorable U.S earnings have been put aside while markets remain focused on real time events in the aftermath of the Malaysian plane crash in Ukraine and the continuing violence between Israel and the Palestinians in the Gaza Strip. The aggressive search for safe havens trading strategies has temporarily fallen since the initial shocks of late last week. Market and investors are seeking clearer guidance from authorities before pursuing any aggressive strategies.

Asian bourses edged higher overnight as investors set aside some of their geopolitical concerns for the moment to focus on the generally upbeat flow of U.S. corporate earnings ahead of a host of results due this week. However, trading volumes remain very light, as Japanese markets took a holiday. Expect Europe to report nothing different as they wait for markets stateside to open.

The next move

The sharp swings and the uptick in intraday volatility are certainly a stern reminder to investors to remain 'fleet footed' and not 'marry any particular position' when volumes remain an issue especially after weeks of calm. There are obvious growing tensions between Russia and the West and the markets will not make a move until they have some concrete evidence. The harsh reality is that during the first half of this year, geopolitical events have had a relatively short lifespan and investors seem to need more assurance before the next move. While the crisis in Gaza has sent oil higher on concern of production risks in the Middle East, gold is having trouble recapturing their risk aversion high print of late last week ($1,326). Participation and lack of physical market interest is finding it difficult to push various asset prices in either direction.

FX technical breakouts on pause

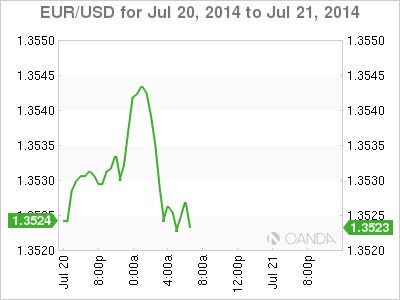

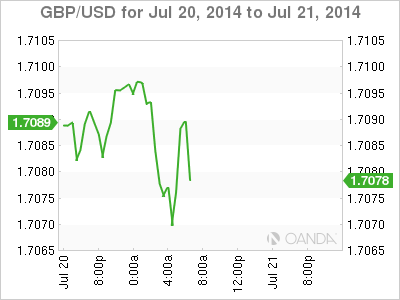

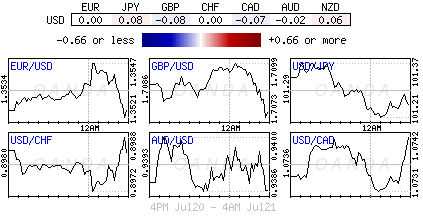

As we head stateside, currency technical levels remain in focus following last Friday's tests for the EUR and GBP both outright and on the crosses. There has been no sustained breakout just yet, especially for the 18-member single unit, which tested and slightly breached the lower end of the trading range at the €1.3500 level at the end of last week. For many, with the pair having managed to hold above the pivotal January low of €1.3477 will allow for more consolidation before the next onslaught with purpose.

Ongoing geopolitical events should leave the EUR vulnerable; especially ahead of a EU foreign ministers meet scheduled for tomorrow to discuss/decide on any further sanctions against Russia. Market participants are required to follow both the treasury and bund yields for clues. Currently, yield differentials are also hinting that the EUR could come under renewed fresh pressure with German 10-year yields probing fresh historically low-levels (Bund 10's +1.16%, U.S 10's +2.28%).

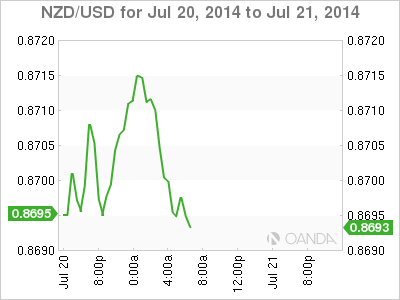

RBNZ Wheeler could surprise

The dollar majors are relatively flat from Friday close levels, but one or two have tried to make an exception. On the fundamental front this week, it is a relatively light calendar internationally - markets will be taking most of their trading cues from breaking news items. However, investors will to watch to see if the Reserve Bank of New Zealand (RBNA) increases its key interest rate for a third-time this coming Wednesday. The Kiwi (NZD$0.8700) was one of the 'exception' currencies in the overnight session that tried to trade through some key psychological resistance levels.

Do not be surprised, that outside of second-tier economic data, the market will be expected to adjust positioning going into the RBNZ rate decision as they do all Central Bank rate announcements. The futures market is pricing in a +75% chance that Governor Wheeler at the RBNZ will raise interest rates again this week to +3.5% - if the CB decides to pause until at least December, there will be a 'few' investors wanting to unwind their long NZD/USD positions.

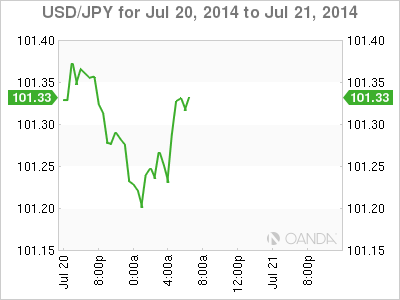

In Japan, investors will look to the June merchandise trade and consumer prices to gauge the impact of the country's April’s sales tax increase. Has PM Abe got it correct? Elsewhere, the July flash-PMI's for China, Japan, the Eurozone, Germany, France and US will also be needed to be interpreted - however, expect event risk to trump all risks.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.