The status quo in the Ukraine was never going to hold, something had to give and it seem the match has been lit over the weekend. Spread of violence to more towns with the uptick of skirmishes between local law enforcement and pro-Russian separatist forces have now taken lives, further magnifying tensions in the global financial markets.

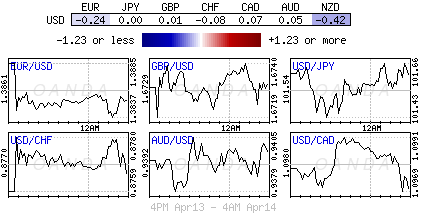

This fresh escalation of tension has added to the pressures of last week's equity technology sell off. Euro bourses are starting this school holiday week on the back foot, especially Germany's DAX index - it's particularly sensitive to events in the Ukraine due to Germany and Russia's close trade ties. Investors should expect any Ukraine event risk tension to be playing a major part in containing "risk-taking" in this new-week. Obviously not helping either liquidity or prices will be the Easter holiday. Already this morning the market has seen the commodities sector benefiting, with the "yellow metal" and "black gold" in demand from a flight to safety assets (up +0.8% to $1,327.20 and Brent $108.08 +0.7% respectively). However, overall event risk continues to remain relatively contained, just look at the movement in USD/Yen. Usually when an asset classes come under stress, historically it is the Yen that get bought the most often. Currently, USD/JPY is relatively unchanged against the "mighty" buck (¥101.67).

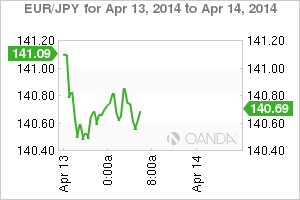

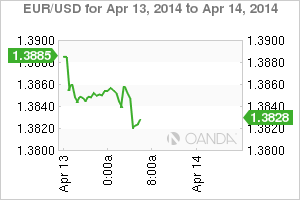

In forex, it's the EUR that is hogging all the headlines, especially after the ECB began stepping up its verbal intervention on the EUR over the weekend. So far this morning, Draghi's dovish comments are fuelling modest gains in the Euribor market and a modest loss for the 18-member single currency. Investors remain unlikely to sell the common currency aggressively unless the ECB backs up rhetoric with action - Euro policy dealers' have yet to declare that QE is imminent. The ECB's go-to tool is rhetoric, with all members "talking the talk." ECB's Noyer has reiterated council view that a strong EUR "trims inflation rate by half-a-point."

The market does understand that a weaker common currency is desirable but easier "to talk about than orchestrate." At this stage investors prefer to see action rather than words. This will make it more difficult for Euro policy makers "to walk down their own currency." There are only so many times that investors can react listening to the "same" message. Euro-policy makers continue to reiterate their European view of no danger of deflation, but they believe further EUR strengthening could have negative effect on economy. Even stronger talk is beginning to fall on deaf ears. All this Euro talk since the weekend has only is able to buy a "modest" decline for the EUR. In the big picture the ECB is running out of "puff" and has probably done all it can with "open and cry" communication. It's very unlikely that the single currency will fall much further on rhetoric alone - the market require some action in a show of good faith. Perhaps asset purchases (QE) may be the appropriate tool to fight low inflation, adding that further monetary easing is not excluded, but remains contingent on outcomes.

From a technical perspective the single currency has seen new intraday lows just ahead of the handover stateside (€1.3806). Even February's Euro-zone industrial data rose slightly (+0.2%, m/m and +1.7%, y/y), although output in many of the currency area's troubled southern peripheries declined.

The rise in output should reassure the ECB that they can expect modest growth, however, signs of weaker domestic consumer demand will continue to have a direct negative impact on Euro inflation. Obviously with domestic demand weaning, Euro goods and services will be relying more on the value of the EUR to boost the competitiveness of its goods and services on the global markets. In the end policy makers must get the EUR down - it's all in the timing. Single-currency sellers are touted on top between €1.3835-55. Through here expect some intraday 'short' buyback panicking. The techies short-term goal would like to see the well protected €1.3800 handle breached, opening the way for the momentum trades to focus on the next support €1.3765-70 area.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.