It seems that risk sentiment is finally beginning to feel some strain. This time with President Obama calling again for tougher sanctions against Russia is having more of an impact on capital markets. The idea that the accumulation of 'any' sanction could now "amount to a lot more that a wrist slap" is gaining ground. Expect the World Bank to begin forewarning the markets that the Putin's 'Motherland' could be facing significant growth contraction and further flight of capital and all because of Crimea. The resolve to break Europe's dependency on Russian gas also seems to be hardening. The stronger the rhetoric gets, the less room the West has to back away.

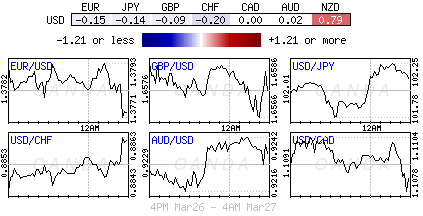

Global bourses do not like the step up in tension - its not unnatural for equity prices to seek lower ground. The mighty dollar and the EUR to date have remained steady, but the single currency looks the most vulnerable and hovers within striking distance of this weeks low outright (€1.3650 continues to be a strong psychological level) on continued speculation that the ECB could be more open to quantitative easing due to the inflation declines in Germany and the strength in the single currency. However, it's the commodity related trio of the AUD, CAD and NZD that has garnered most of the markets interest in the overnight session.

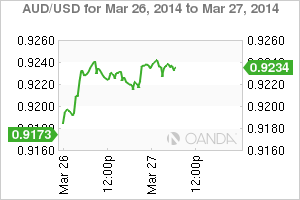

The Kiwi is getting close to testing its two-and-a-half year top ($0.8669) while the Aussie has decided to flounder around its four-month high ($0.9231). Analysts note that the first decline in Aussie housing affordability in 36-months is reason enough to understand why the RBA's Stevens and company are perhaps becoming "less dovish" in their recent rhetoric. Simply put, the Aussie property market is on fire. Home price market gains for various regions, and with Sydney being the top, have been growing at a +20% annualized pace. This is reason enough for Aussie policy makers to consider an earlier than expected RBA rate hike. The fixed income market has begun in earnest to price in more aggressively a 2014 tightening (+2.50%). It was only a matter of weeks ago that the market was concerned about the RBA easing. Governor Stevens does not have the rhetoric power to guide the currency any lower, it certainly worked last year - pushing the AUD into the worst performing category as it declined -15% outright to the USD. The speculative market has been net short the AUD since May of last year, but this week's forceful rally has been able to clear out more short AUD positions and there is some consensus that positioning has turned small "net-long." Positional reports are available next week - they will either deny or confirm this, but no matter, for many the recent move higher has been costly.

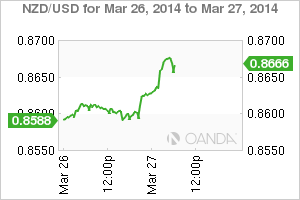

In the overnight session, Kiwi trade number happened to print its fourth consecutive and a multi-month high surplus. Exports rose +17%, y/y to NZD$4.6B, while imports were up just +8%, y/y to NZ$3.7B (an eight month low). Exports to China were again impressive with a +49%, y/y rise, and exports of dairy rose +38%, y/y to NZD$1.6B. With little other data on the horizon the Kiwi should be expected to remain firm and even more so as we approach next months RBNZ meet. This month Governor Wheeler lifted interest rates by +25bp to +2.75% and is widely expected to keep raising them over the next year. The RBNZ's hawkish message has gathered even more steam since the first OCR adjustment a few weeks ago. The Fixed income market is pricing in a cash rate of +3.75% by year-end, this can only garner further support for the NZD.

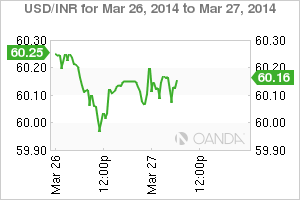

The Emerging Market space continues to experience its own growing pains and whatever happens between the West and Russia they too will "not" be immune. The infamous "Fragile Five" (BRL, IND, INR, TRL, ZAR) recovery still needs to face the real acid test of higher US rates. With US Treasury yields trading in a contained range has been helping some of these less favorable currencies recently somewhat. The INR's current rise to an eight-month high-required CB intervention to slow down the appreciation. On the other hand, it does reflect somewhat the newfound vested interest - this can be explained by contained US treasury yields (US 10's still find it difficult to trade through +2.80%). In recent months, the outflow of capital has been trumped by big inflows into Indian equities and with the "expectations of a strong reformist government in the coming election have boosted the INR. The IDR has moved higher on CB rate hikes and on renewed equity inflows, while in Brazil aggressive rate hikes and better fiscal management have helped their own currency.

However, US yields are on the edge, and are expected to go higher, and if so, any currency with current account concerns will remain vulnerable (just like last Autumn), especially now that Yellen and company are beginning to switch to "timing of the Fed hikes."

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.