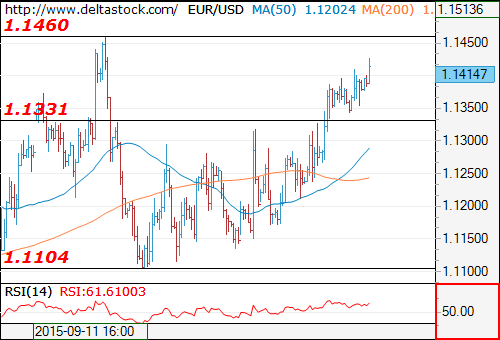

- EUR/USD

Current level - 1.1414

The uptrend here is still intact, heading towards the 1.1460 high, but my outlook is rather counter-trend, for a break through 1.1330, en route to 1.1230 static support.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 1.1460 | 1.1460 | 1.1460 | 1.1565 |

| Support | 1.1330 | 1.1230 | 1.1012 | 1.0930 |

__________

- USD/JPY

Current level - 119.57

The overall outlook here remains bearish, for a break through 119.50, en route to 118.67 low. Initial intraday resistance lies at 119.80.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 119.80 | 120.50 | 121.30 | 122.30 |

| Support | 119.50 | 118.67 | 118.67 | 116.15 |

__________

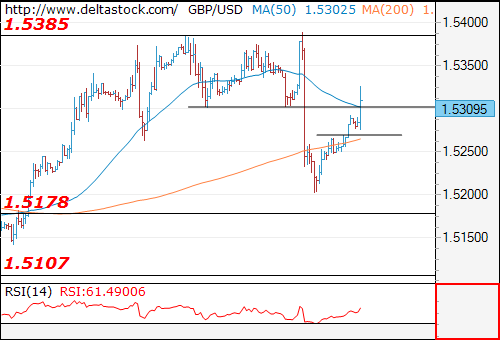

GBP/USD

Current level - 1.5309

Yesterday's slide has bottomed at 1.5200 and the intraday bias is positive, supported at 1.5270. Major hurdle on the upside is 1.5385.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 1.5335 | 1.5380 | 1.5478 | 1.5660 |

| Support | 1.5270 | 1.5200 | 1.5080 | 1.4850 |

__________

| DATE | ORDER | ENTRY | SL | TP1 | TP2 | |

| EUR/USD | October 14 | --- | --- | --- | --- | --- |

| USD/JPY | October 14 | --- | --- | --- | --- | --- |

| GBP/USD | October 14 | --- | --- | --- | --- | --- |

These analyses are for information purposes only. They DO NOT post a BUY or SELL recommendation for any of the financial instruments herein analyzed. The information is obtained from generally accessible data sources. The forecasts made are based on technical analysis. However, Deltastock’s Analyst Dept. also takes into consideration a number of fundamental and macroeconomic factors, which we believe impact the price moves of the observed instruments. Deltastock Inc. assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person's reliance upon the information on this page. Deltastock Inc. shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation, losses or unrealized gains that may result. Any information is subject to change without notice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Deltastock AD is fully licensed and regulated under MiFID. The company is regulated and authorised by the Financial Supervision Commission (FSC), Bulgaria, Reg. No. RG-03-01

Recommended Content

Editors’ Picks

AUD/USD remains firmer ahead of RBA interest rate decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.