The language of forward guidance will be the key element in tomorrow’s announcement, after the Fed’s emphasis on “considerable time” between the final tapering of its third round of quantitative easing and the first rate hike was substituted with an emphasis on “patience”, something unlikely to change in tomorrow’s statement.

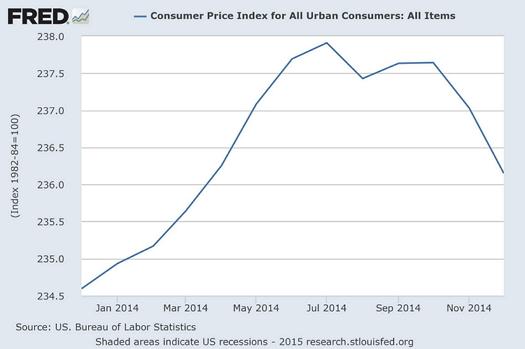

In line with the global decline in fuel prices, US CPI inflation declined to 0.8 percent in December, down from 1.3 percent in November. With lower oil prices unlikely to rebound significantly in the short-medium term, there is anticipation that inflation could fall below 0.5 percent as lower fuel prices feed into core prices.

In addition, the dollar rally forecasted through 2015 will decrease the price of US imports, further feeding into lower inflation numbers.

While the European Central Bank acted last week to unleash EUR60bn of asset purchases beginning in March, the initial effects are market rather than wider economy-based and unlikely to spur European demand for US goods and services in the short-medium term. As Mario Draghi stressed at his announcement of the ECB’s QE programme, there needs to be reform from member state governments for a return to sustained economic growth to take place.

All in all, there is unlikely to be anything in the FOMC’s statement to shake the long dollar-short euro consensus, with the Fed’s March meeting more likely to have greater market impact.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.