Federal Reserve Preview: Powell set to lift US Dollar by leaving door open to more hikes

- The Federal Reserve is set to leave rates unchanged for a second consecutive meeting.

- While inflation is easing, its slow retreat and buoyant job market keep officials alert.

- Fed Chair Jerome Powell will likely stick to the bank's forecasts for another potential hike in December.

- The US Dollar may get a bump from an ongoing hawkish stance.

The last mile is the longest – also when it comes to the fight against inflation. Has it fallen enough? This is a critical question for Federal Reserve (Fed) officials, who are set to leave interest rates unchanged but could still signal a move in December. Markets are pricing out further hikes and could face a nasty surprise.

Here is a preview of the Fed decision, due on Wednesday at 18:00 GMT.

Fed background: Inflation is retreating, labor market remains hot

The holy grail for central banks is 2% annual inflation. Raising rates to a range of 5.25%-5.50% from near 0% and other factors brought headline inflation from 9.1% YoY in June 2022 to a trough of 3%. However, inflation has lifted its head to 3.7%.

Officials are more worried about underlying inflation, which excludes volatile energy and food prices set on global markets. The grind here is slower. Underlying inflation, as measured by the Core Consumer Price Index (Core CPI), has dropped from a peak of 6.6% in September 2022 to 4.1% in September.

Core CPI. Source: FXStreet

The Federal Reserve's overnight rate stands at a range of 5.25%-5.50%, above both measures of inflation and in the so-called "restrictive territory." The bank significantly slowed the pace of raising rates, settling for one hike in the past three meetings, back in July. Another "no-change" decision is expected now.

On the other hand, in its latest decision, the Fed indicated another hike coming this year. The bank's dot plot showed a target of 5.6% by year-end, leaving the door open to another move.

Summary of Economic Projections. Source: Fed

With no new forecasts at this juncture, Fed Chair Jerome Powell will likely insist on another move, leaving his options open. One reason to do that is the buoyant jobs market.

The US Federal Reserve stands out among central banks by having two mandates: price stability and full employment. With a bustling labor market, the Fed was focused on inflation – yet relentless hiring means more money in Americans' pockets, available to push prices higher.

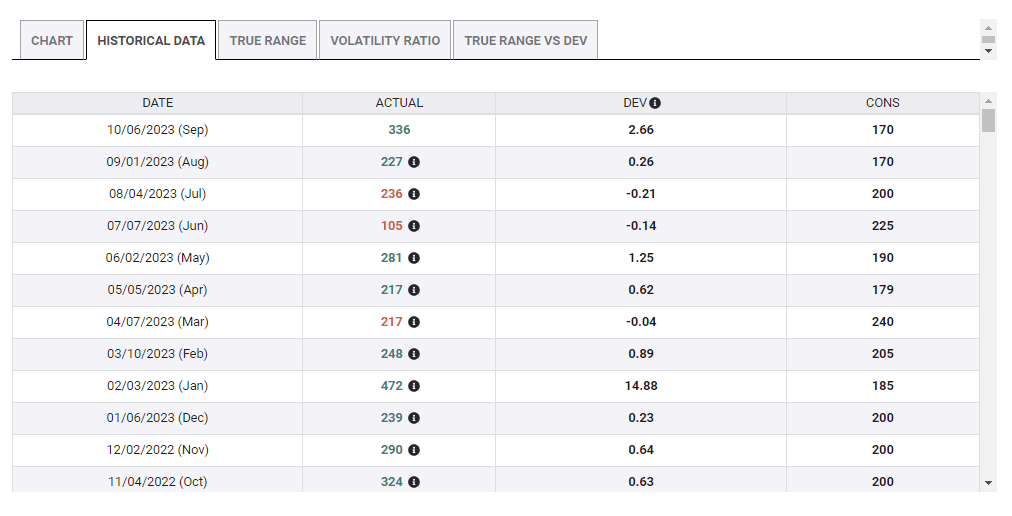

The Nonfarm Payrolls (NFP) report showed a leap of 336,000 jobs in September, nearly doubling early expectations.

US Dollar hinges on Powell words

With inflation slowly falling and an active job market, Fed Chair Jerome Powell has good reasons to insist another hike is on the cards. A hawkish stance would also offset the decision, not to raise rates, which is fully priced in.

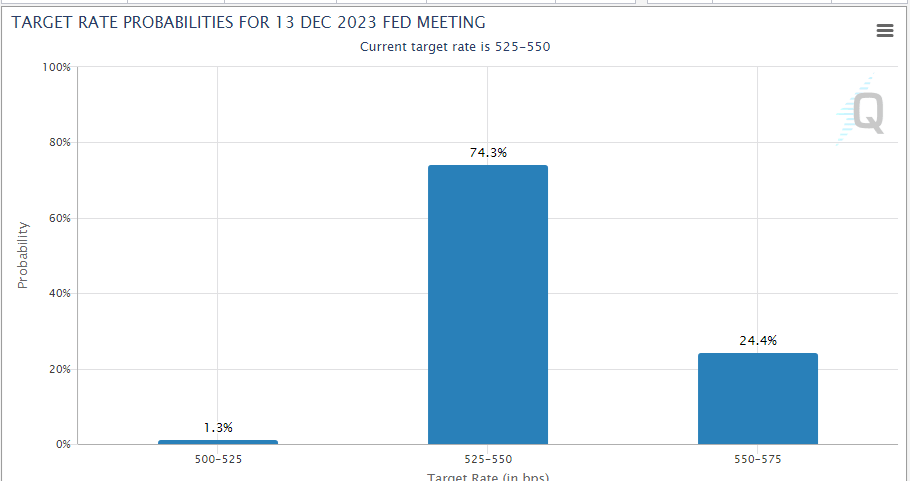

Bond markets see no chance of a hike in November, and give only a 24% chance of a move in December, the last Fed meeting for 2023. This means that a hawkish stance will catch them off guard.

Bond-market pricing of Fed moves. Source: CME Group

I expect Powell to prop up the US Dollar, hit stocks, and weaken Gold.

What is the risk to my outlook? The same bond market. Returns on US 10-year Treasuries have leaped and remain close to 5%. Higher long-term interest rates depress mortgage lending and long-term investment loans.

Fed officials have acknowledged that Treasuries are doing part of the job for the bank. This global benchmark rose from under 3.50% in the spring to near 5% in the autumn.

US 10-year yields. Source: TradingView

If Powell emphasizes the recent leap in yields as a factor that may restrain further Fed tightening, the opposite may happen – the Greenback would weaken, stocks would party and Gold would advance.

I lean toward a more hawkish approach and a risk-off response.

Final thoughts

Responses to the Fed decision come in several waves – the knee-jerk reaction coming immediately after the statement is out, the reactions to Powell's comments, and further aftershocks.

Market pricing just ahead of the event is also critical.The US Dollar slid in the hours preceding the Fed's September decision, only to reverse course, and more. All in all, it is a volatile event, and I urge trading with care.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.